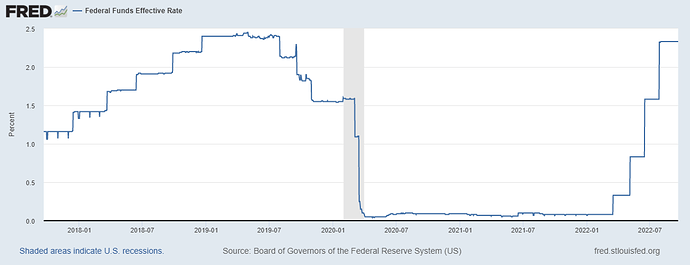

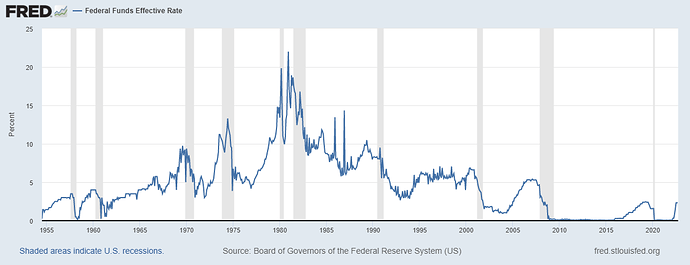

I recall the big increase in 04-06- but that seems like a totally backwards situation from where we are now.

Increasing rates used to be for cooling off a hot economy… but usually things were going well.

I dont recall a time when we were already in a recession (or whatever) and rates needed to get jacked. I recall rates getting cut for recessions to ease the pain, not rates going up.

Pretty sure 94-95 was recession time. “It’s the economy, stupid” kind of got George HW Bush unelected. But that was some time ago and the start of my working career. I do recall some folks worried about Trump pushing to keep free money flowing in boom times was going to come back to bite us in the ass, but I don’t think this predictions factored in a once in a century pandemic and it’s impacts of life in general and the economy in specific.

Did you mean 91-92 or 92-93? Clinton was elected in Nov 92.

OH yeah. 94 was the Contract on America congress.

almost comical that GOP rolled out its ‘Commitment to America’ yesterday…maybe 4 hours after your post. when in doubt, go with what you know.

The futures markets are gyrating this week like a squirrel in a nut store, with lots of activity but no clear direction. up down up down up and down again.

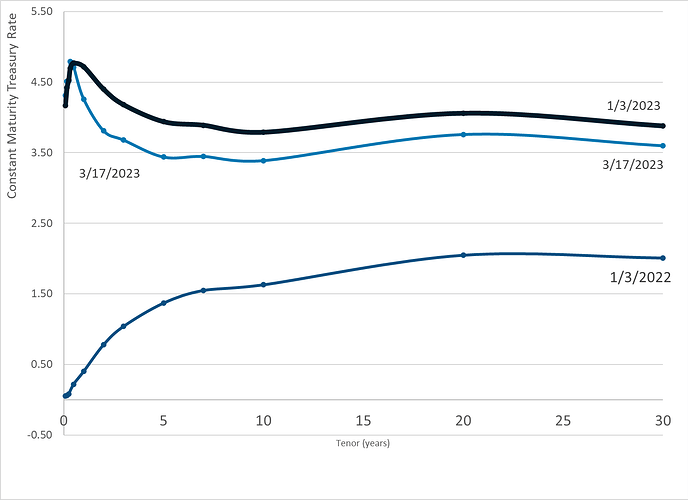

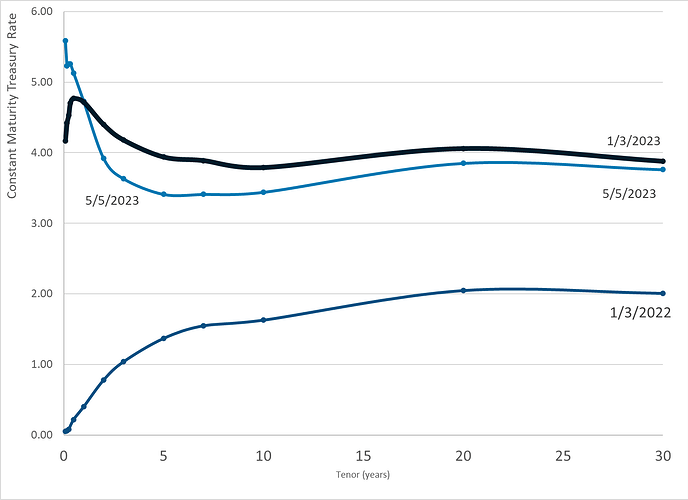

Right now, it appears they’re 50-50 on a 25bp increase at the 03/22 meeting. Then, if they do increase, there’s a 50-50 chance they’ll decrease it 25bp at the 05/03 meeting…and it’s all downhill after that…around 3% by the end of 2024.

if they go flat (no hike) today, they would try to call is a ‘pause’ but really it means the end of rate increases for this tightening cycle. They need to go 25 pts just to keep the momentum.

markets will go nuts if they come out at 0. It would indicate 1: we hit the top of rates and 2:banking crisis is worse than advertised. 3: FED strategy had to change due to unforeseen events, diminishing faith that fed knows what its doing.

from wsj:

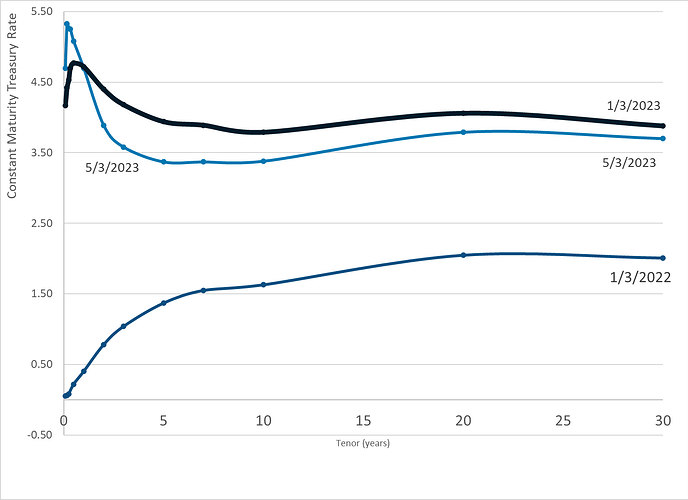

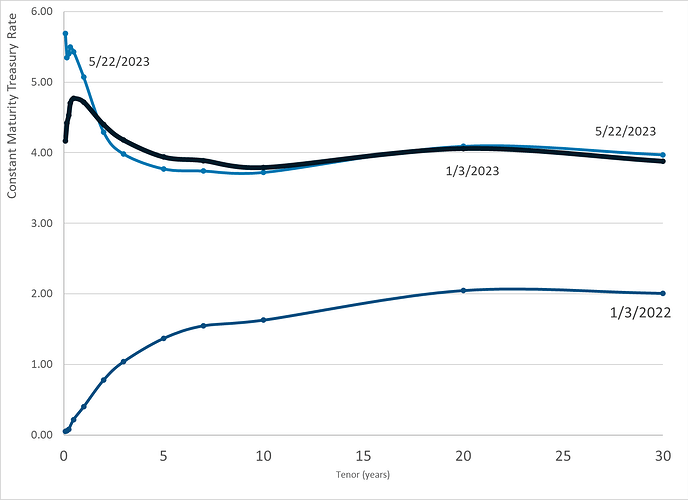

Futures markets are projecting no change in rate at the 05/03 meeting, and less than 50% chance of a 25 bp decrease at the 06/14 meeting. However, the projection is all downward for the next year & a half.

After today’s increase of 25 bp to 5.00-5.25%, the markets are now about 50/50 on a decrease at the 06/14 mtg & nearly certain that it will happen by the 07/26 mtg. By the end of 2024 the markets think the overnight rate will be near 3%.

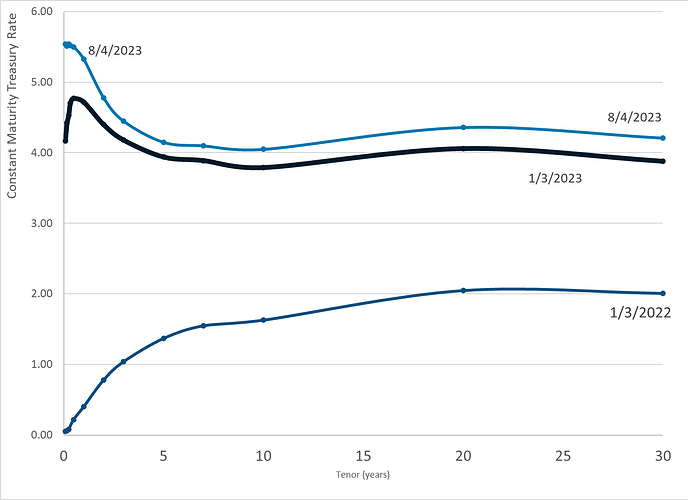

When I look at the crb futures, it’s possible (quite likely, even), though, unlikely, to see an increase at the 06/13-14 mtg, but one is fully priced in by nearly certain (well…maybe 50-50) at the 07/25-26 mtg.

crb futures are certain of a pause tomorrow slightly more than 50-50 of a 25 bp bump at the 07/26 mtg.