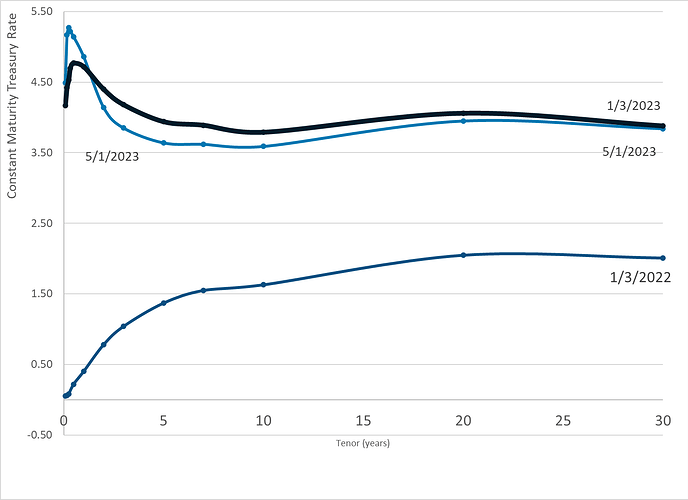

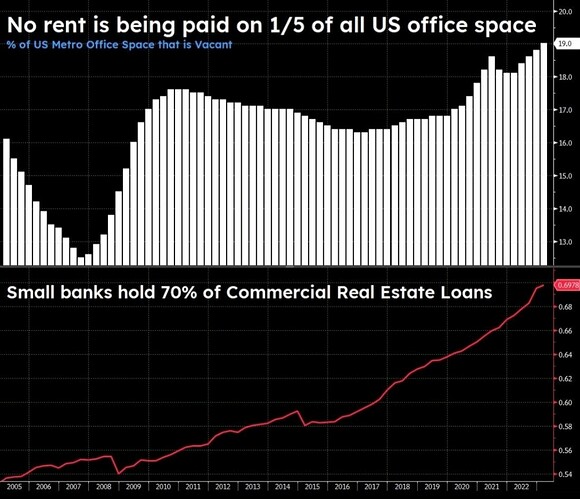

I think a lot of zombie commercial real estate loans are on the books right now. They are setting at low rates, they will adjust, and the revenue on the borrowers side is just starting to disappear. I think the Fed pushed rates too high and may cause economic calamity in the next 10-24 months. They should have stopped between 3% & 4%. They have made not lending way too appealing for banks right now and they moved so fast many haven’t adjusted properly. You would be surprised how few people there are out there that can manage a banks liquidity properly. My dad had that job at a small regional bank with 600 employees and $500 million in assets. He trained their staff for over a decade before the OCC felt comfortable letting him retire (He still sets on their board of directors for oversight). I suspect there are a lot of banks in similar positions and even some that have no one who knows how to do it.

Another interesting article on where banks are right now. I feel like The Fed needs to immediately lower rates by 1% but they are not paying attention to the money supply. They are going to drive the banking system off a cliff.

I am just really unhappy with this:

I mean, ugh. Can we stop with the interest rate increases for a bit?

Is that a bug, or a feature? If you’re TBTF this is a great opportunity for consolidation.

this is just the “reversion to the mean” that we’ve been expecting to happen in our CFT assumptions for, what, 40 years of declining rates? It’s all according to plan.

also, if they were to “stop with the interest rate increases”, how would they be able to say they were doing something? The biggest threat to politicians isn’t unemployment or inflation, it’s negative perception within the voting populace, so their incentives aren’t to actually fix any problems, but to look like they care and are working on a solution. Because if they fix problems, then the voters won’t have any need of politicians any longer, and nobody signs up to public office to work themselves out of a job, amirite?

It looks like Pacific Western bank is next in line…

Or Western Alliance. Or both.

double yay! Even more contagion risk!

I’ve been eyeing USB andTFC as possible purchases. Those dividend yields are really looking attractive, 1Q23 earnings weren’t off a cliff. They seem to be caught in the SVB contagion. Your thoughts?

TD Bank walking away from its US bank takeover offer. Should help TD’s capital position and stock price. Had been hoping this would happen as TD stock is a significant personal investment and the offer price was high given the current value of the US bank.

They will stop now and wait.

Dollar is now taking hits relative to other currencies, and you will now see higher credit spread dispersion amongst US debt (IG specially).

The US has a bit of a regulatory weakness going for it now as it does not mark asset values using the mark to market approach (like in the UK and EU). This then allows banks to hide a deteriorating internal ALM position as they only show the losses once they sell the assets.

My expectation is that short sellers are combing through all the financial reports of smaller and medium sized regional banks. Once you see large positions being built up against the share prices you will know who is next.

Common thread in bank collapses: KPMG

Don’t know if you guys have been tracking the CS story regarding the AT1 Bonds but it is now picking up steam.

In a bizarre twist, the “Antigua News” got a massive scoop regarding a letter from CS to FINMA. They were able to acquire the original and posted them before anybody else in the world.

The guy responsible then talked to the FT (he is quite a colorful guy)

Meet the pizza-loving diplomat behind Antigua News’s big Credit Suisse scoop - Meet the pizza-loving diplomat behind Antigua News’s big Credit Suisse scoop | Financial Times via @FT