Thanks. I am getting low on the number of NYTimes article I can share so didn’t share this one. The one I just shared in the Jimmy Carter thread is an even more unconscionable story than the SVB one.

No worries, I usually don’t hit my limit, you’re welcome to tag me if you’d like me to drop a non-paywalled article in the future.

As predicted, the blowback to their “deal” is mounting.

Switzerland will be battered by this.

10,000+ job losses on the ground (initial estimate)

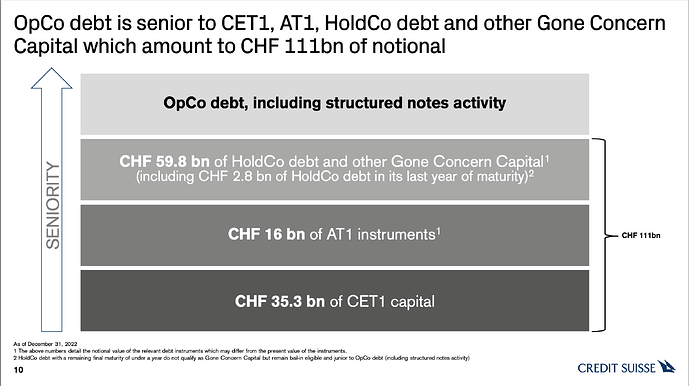

Asian investors are very angry about their AT1 debt being wiped out. Another issue is that it was also being used as collateral in others deals, which has now triggered margin calls.

In short, foreign investors are going to let the dust clear first and then will be a lot more careful about investing in Switzerland.

Reputational damage to the country will also last a while.

Based on some further reading this morning, it appears the contingent convertible bonds in question were specifically designed to be converted into equity in the event of bank distress. So the idea that they would be secured ahead of common equity shareholders similar to other debt was an inaccurate assumption/read by investors. US doesn’t have these, and it’s the first I’ve heard of them, but it’s what I gather at the moment.

Their other ‘function’ is that they have an indefinite maturity, but can be called for redemption by the bank, but such redemption could also be blocked by the central bank/govt if any replacement funding instruments were relatively too highly valued. I still don’t really understand this mechanism tbh. An actual example hasn’t occurred that I’m aware of.

their stock is up 2%!

But UBS shareholders laughing all the way to the bank, so to speak.

From a slide deck released on their investor relations page one week ago…

(Debt investors – Credit Suisse for the source)

Cocos are essentially perpetual bonds that fall into the callable spectrum.

They can be converted to equity or not (depends on the term sheet)

They were primarily designed after the 2008 GFC to be used as shock absorbers (they would be marked down to zero in the event of a serious bank risk event).

They paid very high yields (9-10%) which was reflective of their risk (would be wiped out in the event of a serious bank problem as mentioned).

Tough to be sympathetic to the investors here. The real issue is that Switzerland has put the local people first (this part is logical) and mostly wiped out the foreign investors.

While they could legally do this, the legal and reputational damage is going to be immense. The legal outfits are massing for huge lawsuits against the deal (given the $17 billion wipeout not all that surprising).

Ah, missed the local vs foreign connection. That makes more sense now.

More on the industry fallout from the Swiss regulators treatment of the coco bonds

Explainer: Why markets are in uproar over a risky bank bond known as AT1 | Reuters?

Blurb from Bloomburg today:

The biggest short in the banking industry [link.mail.bloombergbusiness.com] anywhere in the world isn’t in Switzerland or Silicon Valley, but rather, in the relatively tame financial center of Canada.

In recent weeks, short sellers have upped their bearish bets against Toronto-Dominion Bank, and now have roughly $3.7 billion on the line vis-à-vis Canada’s second-largest lender, according to an analysis by S3 Partners. That’s the most among financial institutions globally and puts TD ahead of the likes of France’s BNP Paribas and Bank of America.

TD’s biggest problem is its pending purchase of a US bank, First Horizon. That deal was struck before before the SVB disaster so the price now looks greatly inflated. If TD fails to close that deal it will be a much stronger bank as a result. US regulators initially resisted the deal but now want it to happen.

TD Bank is in the too big to fail category.

Yay! contagion risk!

I strongly doubt TD is actually at risk of failing at this point.

The short sellers bet is actually quite small. I hope they get burned. If I wasn’t already up to the max I want to hold in equities I would add some more TD to my portfolio given its current price and dividend yield.

First Republic is likely going to be taken over by the US Govt. They are circling the drain after a 95% haircut in share price.

First Republic works on plan to prevent government seizure - First Republic works on plan to prevent government seizure | Financial Times via @FT

Silicon Valley Bank (SVB) failed due to a perfect storm of incompetent management, insufficient supervision and weak regulations, the Federal Reserve said in a report Friday.

I doubt the storm was as perfect as they would like us or them to believe.

First Republic is now officially toast. JPM is taking over its book.

The 2023 Credit Crunch is now fully underway.

JPMorgan to acquire First Republic’s deposits as US regulators step in - JPMorgan to acquire First Republic’s deposits as US regulators step in | Financial Times via @FT

What do you see happening next?

The banks that are heavy in commercial property loans will start taking hits to their share prices as investors start moving away from them.

I would avoid exposure to banking stocks for at least a few years as the ripple effect will not be uniform.

Further consolidation of the US banking sector looks quite likely as well.