fair enough, thought that might be the response

Yeah, the idea is to reclassify Trad → Roth up to the income amount that would prevent you from getting the max subsidy, then pull from Roth for your life needs.

I get the frustration if there are residents who can’t get care, but is it moral to attempt to require someone continue working in your area? I suppose if you’re just playing the shame card with them, whatever.

The wife is a receptionist with no higher level education

If you’re inclined they started posting online in like 2014. They basically started from $0

They do not impress me because they are poor and to my knowledge still not retired yet

Does he want to work or does he have to work. Maybe you are making his job too easy ![]()

Same when I retired at 51. No resentment, but everyone assumed I’d pop back up somewhere else.

Well I’m here to tell you it’s not a very large amount, 30K ish

Share your life on antisocial media, you’ll get what you deserve.

The moral of the story, yet again,…

They wrote an ebook and I assume this is just another way for them to get their name out there

Not a bad marketing tactic

Though we still need to run out the by-paycheck filling-up of our HSAs and 401ks, I just filled our second Roth IRA for the year to make the first year we’ve fully maxed a dual 401k/IRA/HSA.

It’s a nice milestone.

I’d like to point out a consideration here that we are kinda glossing over.

When some people say “retirement” they mean that they are done with earning paychecks, period end of sentence.

When some people say “retirement”, like OP T-roy here and his B&B dreams, he is actually talking about. giving up the career and switching to another job outside of their original profession. It may be related to a favorite hobby, or dream location, or a secondary skill set. Sure, maybe it pays less, but that doesn’t mean it’s the same as walking away from the workforce 100%. When some people talk about FIRE, they are really often talking about giving up the high pay, high stress job and moving to some preferred, lesser paying job, and that includes tik-toking, influencing, blogs, vlogs, newsletters, etc.

I’d love to find a job that would be meaningful enough to me that I’d do willingly, and extend my working year, especially if the retirement job had health insurance until I hit medicare.

That can’t screw you on your SS benefit, can it? Say you were in the rat race making 100k per year, but then semi-retired to a more meaningful job making 25k per year for 3 years. That screws up your avg salary over the last 10 years of your working life, but is that going to reduce your monthly SS payment?

It’s kind of a coastFIRE depending how much work it is. Barista FIRE usually refers to getting a part-time job to keep insurance benefits and the like.

If it’s more than coastFIRE, it’s just a new job.

After I retired at age 58, I went on two boards for about 10 years that paid $20K and $35K respectively. Fascinating work that drew on my actuarial experience and only about 200 hours work per annum. There were no professional liability issues as the organizations provided an indemnity.

The Canadian equivalent to the OASDI (CPP) has a feature in this situation that does not hurt your accrued benefit. I started my CPP pension at age 60 but contributed to CPP while working on the boards and that bought an additional pension. It operated on a pseudo-DC basis, a bit like the French Repartition system. The bottom line is your low salary after retirement did not hurt your SS pension.

It has been a long time since I was involved with OASDI so I don’t know if it has something similar. Probably not as it is has never been an innovative system.

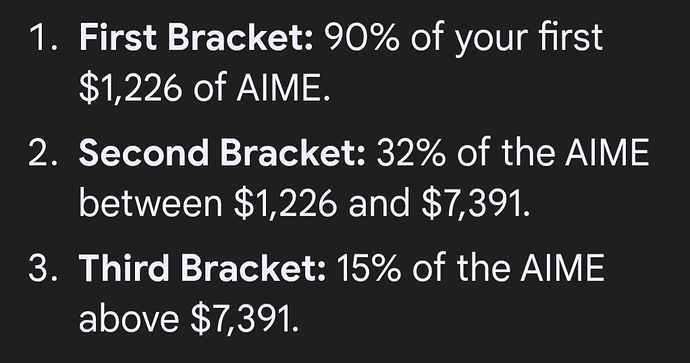

No, they adjust your annual earnings for inflation, and then take your 35 highest paying years, and run that through some arithmetic. If you didn’t work for 35+ years then some will just be zero.

There are some bend points, for many actuaries and other high earners, you may not get a huge bump for continuing to work the 35 years.

I have passed another $100k milestone in my stash. One step closer to not having to care about work anymore.

Sobering reminder about how critical social security pensions are to most folks.

I think marginally each additional

(35x12x1)/0.15 = 2,800

Gets you another dollar of social security each month?

Yes, but high earners are likely high earners at the end of their careers. Dropping off the earliest years when you were less than the max AIME and getting full AIME years at the end of your career should improve the average, right?

I read this.

It makes sense, from a strictly actuarial perspective, that the cash flow of the annuity that people will receive in their future has an actuarial present value. This may be news to some people. It SHOULD NOT BE NEWS to a group of actuaries.

The author proposes that the tax rate be increased to 15.9% from 12.4% to fix the projected shortfall. I like this idea, much moreso than cutting benefits.

The author also suggests that rich people should pay more.

I hate when non-financial people write internet articles when they don’t understand the difference between high income and high wealth. They are not the same.

People who had high income and low wealth SHOULD NOT be entitled to more social security than people with lower income and higher wealth. The system should NOT encourage people to have profligate lifestyles. The system should NOT encourage people (or a new cottage industry) to hide their wealth.

Social Security is a social insurance platform. Social Security is not and should never be construed as a welfare program. Means testing should NEVER BE ALLOWED.