Clearly that shouldn’t pass, the example to use is when 43% of the country can force a massive bill on 57%. Tyranny of the minority.

I am not sure what bill you are referring to. TCJA?

You mean like 2017 TCJA that will cost upwards of 2 trillion dollars pushed through by a minority of the electorate?

I mean, if you have to choose one tyranny, I would prefer tyranny of the majority over tyranny of the minority.

Of course, there is more at play than just this.

do you like cycling by any chance

just wondering

I’m impressed. EDIT: but yes I am. was it the username?

Which minorities should be protected with the mechanism of extra votes in the Senate?

We have about 2 million Vietnamese Americans. There are 14 states with populations under 2 million. Maybe the Vietnamese Americans deserve two dedicated votes in the Senate.

We could look at any minority group, there might be 2 million Americans who enjoy racing cars. Maybe they deserve two senators. …

I don’t see anything special about “sometime, more than 100 years ago, Congress drew some lines on the map. It looked like a lot of land area, but it wasn’t great farmland and very few people moved there.” deserves two votes in the senate.

Yeah. At first I thought it was AG43 because actuary but no, it’s really AG2R, the team. Because nobody would be interested in the actual company.

Remember: The reason we have two Dakotas is the Republicans of the day wanted the extra two Senate seats and three extra electoral votes.

(“Republicans of the day” = the party has changed quite a bit since then)

This is key. I keep reading left leaning articles stating how unfair it is that 1 person can torpedo legislation like this. Actually 51 people are torpedoing it and public polling shows the public does not support the legislation.

I am also every intrigued that all the sudden Manchin allegedly made comments that parents were going to buy drugs with their Child Tax Credit money.

The politicians.are experts at working the media to do their bidding.

According to this poll only 41% of people support the bill.

And only 34% oppose the bill.

The Ds have had this problem for as long as I can remember. You can’t hold up “a big tent” as a virtue, while simultaneously despairing that one or two won’t fall into line.

my opinion, if you care

or if you don’t. that’s fine, too

I agree on the SALT cap (I don’t even itemize! >:( ) and annoying accounting tricks.

I will point out though SALT is probably only in second place because of said accounting tricks. Like they’ve included just one year of the expanded child tax credit cost it looks like.

thanks for posting that. not sure who is hung up on the SALT thing, but agree that it seems like an easy thing to remove from the bill. your points about the location and pressure on local taxes would be different if people felt more of the double taxation that would come with $0 threshold. how conflicted would you be if removing SALT changes got BBB to pass?

also appreciated the accounting tricks. they are everywhere - are they at least historically consistent? the 5 years of spending vs 10 yrs of collecting - that’s the bill so CBO crunches those numbers. do they at least do so faithfully and consistently?

Yeah, I know, but I’m not going to go to the bother of trying to make a “realistic” estimate of costs

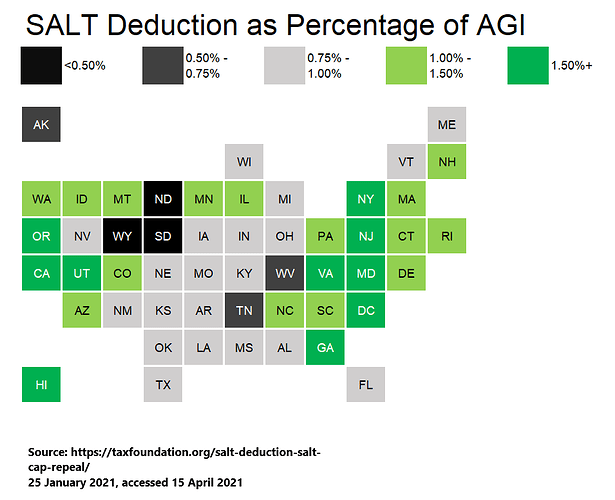

It’s various politicians from my area. I’ve been following the SALT cap saga ever since the TCJA managed to get passed.

Let me just dip into some of my greatest hits (which is mainly looking into reactions), in no particular order:

April 2021: SALT Cap Tussle: NY Democrats Have an Ultimatum

August 2021: Taxing Tuesday: The SALT Cap Battle Continues

May 2020: MoneyPalooza Monstrosity! Looking at the SALT Cap Provisions

July 2019: STUMP » Articles » Taxing Tuesday: SALT cap zero! Great new taste! » 2 July 2019, 11:31

August 2018: STUMP » Articles » Taxing Tuesday: A Local Discussion on the SALT Cap, and Other State Options » 7 August 2018, 14:43

The Economist had an article about the SALT deduction. It’s crazy that this is even in there, all the benefit goes to the highest of the high income. 0.1% and higher on the income scale.