Yes, i think share of imported goods.

Good site for tracking all of the tariff movements and impacts so far.

Canada now revisiting F35 purchases. And many cards still left to play.

If we can just convince Europe to buy our oil and gas, instead of America’s, we may catch Trump’s attention. Our new PM has no plans for a meeting with Trump: going to Europe next week instead.

Until recently, the notion would have seemed crazy. After all, most western economists have long seen capital inflows as a good thing for America, since they have helped to fund its US$36 trillion national debt and business. For instance, [Elon Musk](https://financialpost.com/tag/elon-musk/), Trump’s advisor, has benefited from Chinese investment, some of which is private.But some maverick economists, such as Michael Pettis, have long dissented from this orthodox view. Pettis sees these capital inflows as not “just” the inevitable, and beneficial, corollary of America’s trade deficit, but as a debilitating curse. That is because inflows boost the dollar’s value, foster excessive financialisation and hollow out America’s industrial base, he says, meaning that “capital has become the tail that wags the dog of trade,” driving deficits.

Pettis wants curbs, like taxes, therefore. And six years ago, Democratic senator Tammy Baldwin and Josh Hawley, her Republican counterpart, issued a congressional bill, the Competitive Dollar for Jobs and Prosperity Act, which called for taxes on capital inflows and a United States Federal Reserve weak-dollar policy.

“[The trio’s] ultimate goal isn’t a series of bilateral [trade] deals but a fundamental restructuring of the rules governing global trade and finance [to remove] distorted capital flows,” says McNair. “Whether this approach succeeds remains to be seen, but the strategy itself is more coherent and far-reaching than most observers recognize.”

Either way, the key point to understand is that a shift in economic philosophy is emerging that is potentially as profound as the rethinking unleashed by John Maynard Keynes after the second world war or that pushed by neoliberals in the 1980s. As Greg Jensen of the Bridgewater hedge fund recently quipped, paraphrasing Milton Friedman: “We are all mercantilists now.” Don’t expect that to be reversed any time soon.

She (Gillian Tett) wrote that on the FT.

And again, not one mention of any plan for the US Debt market.

I can write white papers as well. Dozens of them.

But they are largely meaningless unless you have a serious plan for implementing them.

I don’t see any of that here.

How do you prevent the rise of a right wing populism that is different than what has happened in the US? We lost jobs in manufacturing and coal mining in appalachia that has sharpened in the political divide over the past 20 years. People did not move from West Virginia to North Dakota when good high paying jobs, or at least not fast enough or at a high enough rate to prevent the political class resentments that created Donald Trump.

We have already lost many well-paying factory jobs the way the US lost them over the last 50 years without social disruption. Our social programs cushioned the blow better than in the US and will continue to do so.

Our car industry is quite small currently so if the balance of that manufacturing disappeared it would be a small percentage of the overall population. There will be larger opportunities in resource, construction and alternative energy industries as we focus more on them.

The social programs in the US are apparently good enough that someone is willing to remain in WV and live off them rather than move to ND and prosper. Meanwhile they complain and vote endlessly for politicians that promise them coal mining jobs in the next town.

I am trying to imagine what a better social program looks like that provides towards better results. What could work is a politician telling his constituents to move out of the state to find a better life since that is the reality in a lof of places that depended on coal historically, but that does not lead to a very long career in politics.

I think that one could make an argument that the economy shifted so quickly, starting in the 90s, that a revival of populism was inevitable. But left wing populism was a thing in the late 1800s and early 1900s, so maybe if the Democrats had catered at all to it then we wouldn’t have a purely right wing populist movement.

Do you at least recognize that you may be wrong about what’s happening?

Wrong about what?

None of what you posted is new.

What I have an issue with is their inability to come up with something workable in the real world.

I work in the City (London), and if I came up with such a harebrained scheme I would be laughed out of the boardroom pronto.

This touches off on an important point:

Crackpot ideas and theories are now being legitimised by Trump and his entourage.

And most rational and logical people will have an issue with that.

There’s also the whole college degree inflation thing, and the sky high tuition. If your economy becomes heavily services and tech oriented, then the narrative is that you need a college degree to “get ahead”. In an economy that is more “industrial”, you can just attend community college or trade school, often for free, and you immediately get a job after graduating. That’s mostly the situation in Germany, Canada, etc. The Biden administration actually grasped this and they were making policy moves to bring back many industries that provided relatively high paying jobs for non-college grads. The problem is that whenever you want to make these big reversals, there is short term inflation spikes as it takes time to build capacity.

They are not “crackpot” ideas, that’s what you don’t get. You refuse to even try to understand what is going on. The Biden administration was also going down this route.

Using tariffs to try to replace income tax is a crackpot idea.

This is the kind of thing you are dealing with here.

If you actually wanted to improve things, targeted public investment into education, infrastructure, and transport is the way to do it. Biden was doing some of this.

We have discussed this many times on here because people in the deprived left behind areas do not move. Their geographical labour mobility is poor.

Free trade as written in textbooks is a “dream” that never really materialized. What really happened is just labor arbitrage and abusing cheap labor for the benefit of the usual suspects. Now the USA is trying to undo this mess, and it’s going to be interesting to see what happens. I always said I was a big fan of Joe Biden, he tried to do this as well. But he doesn’t get the same benefit of the doubt as Trump, primarily because Trump has a cult like following and people think he’s a business genius. When Trump says “this will work out in the long run”, a large number of americans really believe him.

American manufacturing is 10% of the economy. It’s way too low. Americans are good at making things compared to other things. If we actually had the conditions for free trade, american manufacturing would naturally make a huge comeback.

Investing in infrastructure is an idea that Pettis also proposed, among others. He says that large amounts of foreign capital could be used to finance America’s infrastructure spending and that could potentially work as long as those investments return economic gains.

The US can make widgets for domestic consumption.

Of that I have no doubt.

But am curious,

When you have tariffed the entire world (and they have tariffed you back) how are you planning to sell (export) that excess production of widgets to generate more $$?

Or is your plan simply to run a completely closed US economy that does not export…

The idea is that the global production distribution among countries is far away from the optimal mix that would happen under free trade. So some countries are doing too much manufacturing and others not enough. Can tariffs move the world towards a better, more optimal, production mix? That’s the idea, I think. So in the short run, yes we will have inflation as the tariffs act like a sales tax. But in the long run, we may be better off, globally speaking, and probably much better off for the American working class.

This is very much incorrect. There is far too much wishful thinking here.

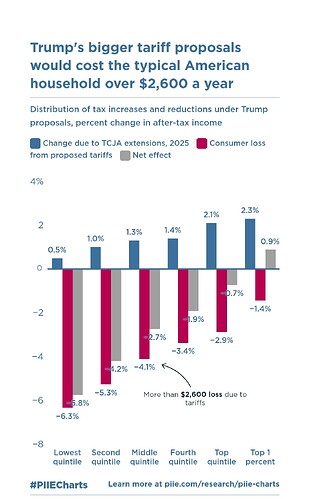

Look at the impacts. The working class in the US are about to be hammered.

Economics is not a science. People have different ideas, beliefs, opinions, even among experts. The point is that is policymakers aren’t listening to the mainstream people anymore. Michael Pettis predicted the China slowdown, and his ideas have influence. I’ve read some of his stuff and he’s rather convincing. So all I am saying is that it’s foolish to assume that was is going on will harm the United States.