So you’re saying I should hold onto my gold?

Yes. Demand will keep increasing (due to Trump and his behavior).

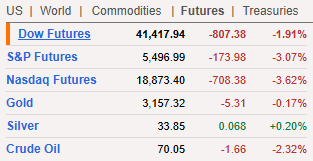

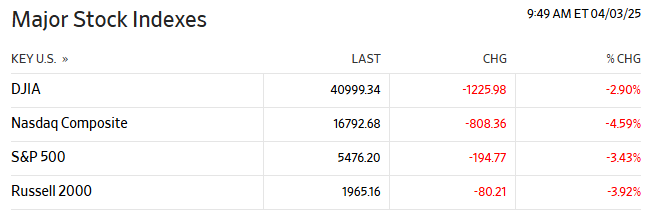

As predicted:

Just to add to that…

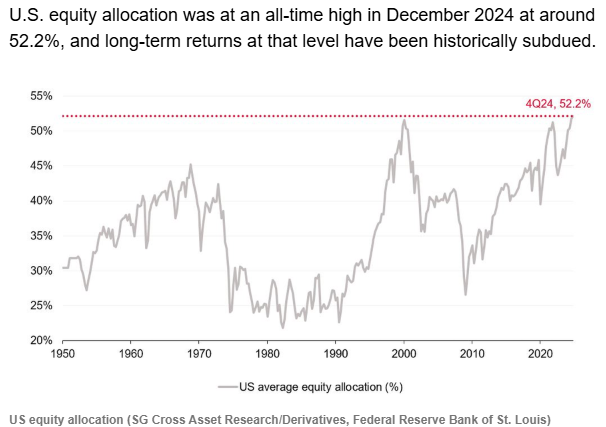

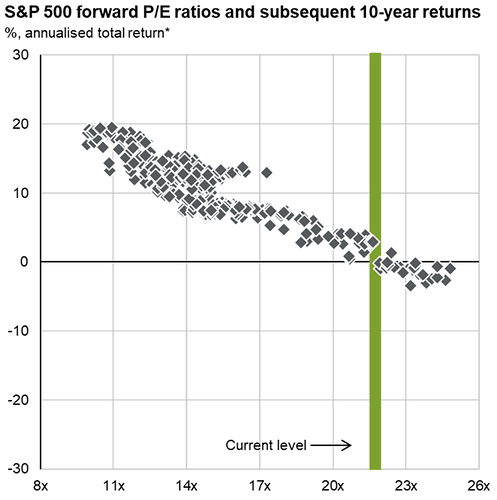

Historically, tariffs are pretty much always followed by massive equity losses. Having equity returns at such a high level (today) just reinforces the point. Its going to be a long way down.

Newsmax must be the next meme stock. I saw it did an IPO at $10 on Monday, and shot up as high as $265 yesterday. At one point yesterday, it was worth more than Fox. I was thinking people love propaganda. It’s crashing hard today, back down to about $60 at the moment.

Still seems stupid

fool money party something like that.

Can we change the thread title to something like “Stocks go down and down and down…”?

See how much I lose tomorrow holding:

| 18.5% | Gold |

|---|---|

| 18.1% | Bonds |

| 13.6% | Short Term |

| 11.8% | International |

| 9.0% | Insurance |

| 8.3% | BRK-B |

| 6.9% | Pipeline |

| 4.3% | Stock |

| 3.4% | Silver |

| 3.3% | Cash |

| 2.5% | Real Estate |

I’d be tempted to lock in some of those gains on gold. It’s up 40% in the last year and it doesn’t seem like much of that is due to the dollar weakening. Uncertainly levels in the economy and other similar metrics are through the roof right now - that almost certainly going to stabilize and profits will be taken on gold.

It doubled during the GFC and went up 25% during COVID. It feels like its going to run out of steam unless this tariff war starts to hit the dollar.

The relative strength indicator (RSI) has frequently maxed out around 75 when gold takes a breather, but when that happens it usually levels off or sees a modest decline before launching again. I will of course read articles to try to understand if gold will continue to be bought in droves.

I am tempted to lock in some gains in my retirement accounts. I’ve got a 20% gain ($9,700) in a taxable account that I don’t particularly want to sell short-term and hand Uncle Sam up 12%-20% of that.

I’m just going to put these here, for future reference.

If the s&p gets to 5585 tomorrow, it’s an up week, right?

This all sounds incredibly bullish and a great time to buy on margin, with leverage, for coming massive gains.

Looks like I’m -1.12% after the first half hour. About 1/8 of my holdings are in bond mutual funds that won’t show movement until after market close. And -0.12% YTD.

-0.96% after 1 hour

-1.02% after 2 hours

-0.88% after 2.4 hours

HORK

My intuition to recently lean into international holdings was wise, could have gone much much harder though.

-3.92% on domestic holdings, -1.25% international.

Update: -4.02%, -1.29%

Update: -4.04%, -1.31%