I assume these are just statewide averages? Would be interesting to see the breakdown by major city within the state if that is available. There is a huge differential in Canada between costs by city.

Statewide medians.

Thanks. I was also wondering if they were averages or medians as that can also be quite different.

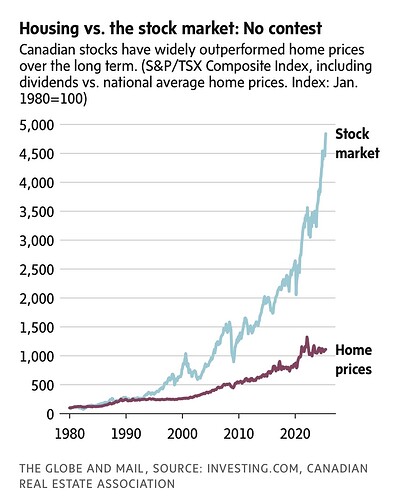

I expect this is the relationship just about anywhere. It simply reflects the difference between an asset with no cost of carry and one with a significant cost of carry.

Houses are two distinguishable assets. One is the land and the other is the building. The land is a finite resource and is subject to rents. The building is a depreciating asset that requires in the neighborhood of 2% to 3% " upkeep.

The graph merely reflects the net growth of differing exponential patterns.

If housing could be expected to appreciate similarly to investing in the stock market, then being a landlord would not be an alternative to investing but simply the only reasonable method of investing. You would want to rent the house for some duration of time, then exit when you want with your stock-market-level appreciation.

Also, lower-income people would be even more priced out of homes.

you have to include the cost of rent per year (compounded) or else the return of renting out the home per year (also compounded) to get a comparable graph of returns. then to be more complete, compare tax treatments as well and include maintenance and property tax. But I suspect rent is the largest driver.

Anyone using the Fidelity Visa? Just watching a You Tube video and thinking about adding it. I have not applied for a card for a few years. I did get turned down a couple years ago last time I made any applications.

My CCs are:

Costco: 5% gas at Costco, 3% at restaurants, and 2% at Costco wh/.com

Amazon: 5% Amazon

Amex: 6% groceries and streaming, 3% at gas stations, although the annual fee cuts into that.

That covers most of my spending. I’ll get 1% at everything else, so I am giving up an extra 1% where I could benefit from another card.

I have the following:

Citi double cash 2%

US Bank user selected 5% categories (Internet, Fast food)

Discover rotating 5% categories

Robinhood debit 2% on gas and groceries and roundup investment into my brokerage.

I have other cards that I don’t really use because the bonuses are better with these. Not really thrilled with CITI and it sounds like the Fidelity card has nice side benefits and I like the idea of funneling bonuses directly to my brokerage. Add to that my 401k just switched to Fidelity and I like the idea of having most of my financial transactions on one platform. Possibly I might consider banking with Fidelity too, I don’t really get much benefit from my Credit Union.

I’m passing up some free interest at my credit union since i don’t make the monthly debit transactions minimum. I should probably change that. I can manage it down and transfer back to Fidelity and hold TBIL which will give me a better return anyway than the savings rate at the cu.

I’ve got 3 credit cards now

Capital One Savor: 3% dining/entertainment/groceries/streaming services, 1% everything else, no annual fee. Sports tickets qualify as entertainment, so between season tickets and dining out it racks up a pretty decent reward balance for me.

USAA: 1.5% cash back on everything, no fees

I pretty much use these 2 cards for most things. I also have a Delta Amex Gold. I pay for that solely for priority boarding and free bag check, as I don’t fly enough to have status anymore. I pretty much use it only for Delta ticket purchases now.

5% AAA for groceries (and I think gas?)

2% Citi double for most other things

Chase family of cards (Freedom etc) for the quarterly 5%, for their willingness to side with you in disputes, for rental protection, and for the extended warranties. They do either 1.5% or 1% depending on the card.

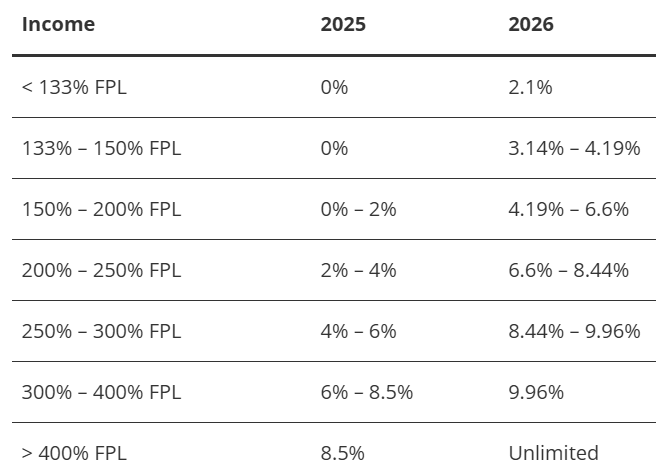

ACA contributions are increasing from Biden-era levels. Next year the FPL will be $21,150 for a 2-person household. I have four more years of deferred income at about $34K arriving, that alone puts me at 161% so I"ll be paying 4.7% of $34K for healthcare = $1,600 I know cry me a river right?

Interest and capital gains will push me higher. 300% FPL is only $63,450 so if I make another $29.5K above that I’ll pay 10% of my AGi in taxes or an additional $4,745. The ACA marginal tax in that band would be 16.1% to say nothing of federal, state, and possibly self employment taxes.

One option might be to open a solo 401k (or a SEP IRA?) so I can stash away more money and lower my AGI. As long as I’m thinking that I might do well to make some contributions this year as I’m already approaching 7%. In four more years I will have substantially less deferred money coming my way, at age 59.5 I can drain the 401k? I know this is small potatoes to the rest of you with your big-actuary tax brackets. just trying to be smart and make my $1.77M last.

ETA: I finally deduced that a SEP IRA is what I wanted. Goodbye AGI (well, part of it)

that is an important goal. I forget what you assume for SS income and at what age. safest is to not rely on anything. realistic is 50%-75%

cFireSim attempts to model your success rate by applying returns from the last 125 30-yr rates of return. I’m assuming 70% equities 20% bonds 10% gold.

If I put in 100% social security starting in 2032/2034 the website says I could withdraw an inflation-adjusted $96K every year and not run out of money in any of the 125 scenarios.

Let’s say I give it a 25% or 50% haircut. Now my 100% success rate withdrawals would be $89K and $83K.

That’s ignoring a bit of side hustle money. And I’m probably only spending 60K or 70K per year including my $1,009 mortgage which disappears in 2.5 years. I’m not worried at all. It doesn’t hurt that up 18% up from my original retirement goal (1.5M)

Medicare starts at 65, so any social security $$ between 62-65 could generate a little ACA tax, that’s one reason to defer it a few years.

Going to be reading this book when it comes out here in the UK (Oct 14th)

Heard good things about it. I find books like this useful in relation to learning how people make financial and economic decisions at the margins in serious economic downturns.

I’ve got an insurance company kicking in some dollars to do a talk on finances to engineers at uWaterloo. and the engineering folks are on board because I’m the fishing with nerds guy.

which means I think, that I can deduct my fishing with nerds trips!!! they become a business advertising expense. and I think that’s actually reasonable.

maybe not as reasonable, gonna ask the accountant if I can buy a new boat lol. probably not.

Sounds interesting, but I thought we already knew all about this.

The wiki article is free.

I’ll try to borrow from the library (no room for new books in the house).