Yeah, your situation definitely became worse, since now all of your partner’s income is likely taxed at a higher bracket than it was before you got that raise (or new job? Congrats either way!). I’m surprised it wasn’t an issue at all before though!

My investment income has been ticking up so I added an addition $ 100/pay period. I’ve never owed so I feel pretty safe that the extra $ 2600 will keep me from owing a penalty.

stripped from context…high class problems for sure. annoying for sure.

i have a SAH spouse. i earn infinity% of their earnings but it is simpler

So does NerdAlert, so she gets it, I’m sure!

I wouldn’t be able to sleep at night if I couldn’t reconcile my layman’s spreadsheet calc to my paid tax software to the penny. Of course I am an actuary with a touch of the OCD, but I’d want to know why there’s a discrepancy and is it my fault math-wise, my fault documentation-wise, or a software issue with the service (i’ve been using Taxact for several years and it’s ok, but not the best and I am open to suggestions on alternatives)

It was either one or two years ago where [tax software] under-calculated my state tax obligation. When I did it by hand and then with a different software, I got a different answer. I wanted to go with the wrong number because >$ for me, but figured there would be a big ass asterisk next to the “our calculations are guaranteed” guarantee such that id be the one on the hook for the misstatement

Did you figure out what was the cause of the discrepancy? I would have to, just so I would know which one was correct

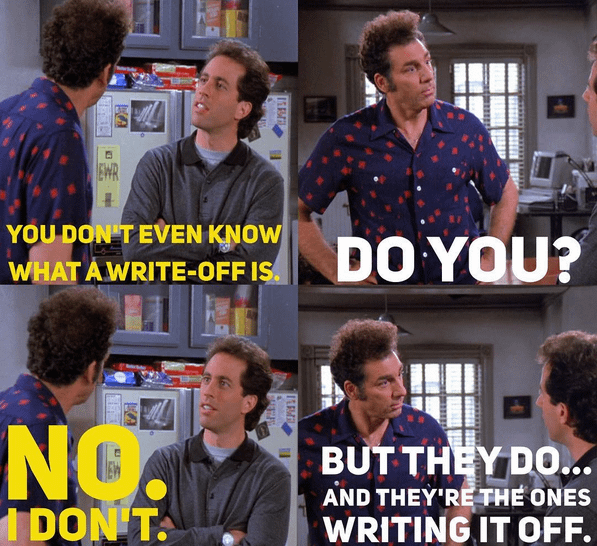

I don’t recall the specifics…I think wrong-software was letting me write off something that I wasn’t allowed to.

Well this could be a nice little newlywed “surprise” for us when we start putting together our taxes in the next month-ish ![]() The SO and I redid our W-4s after we got married and both checked the box in Step 2c on the Federal form.

The SO and I redid our W-4s after we got married and both checked the box in Step 2c on the Federal form.

Some back of the napkin math tells me that our taxable incomes were virtually identical in 2024. Like within ~$1k of the other. I knew we were close-ish, but not that close. The SO had some dividend income which they withheld an additional amount for half of last year - we’ll have some additional tax due on that. I also converted $7k to a Roth IRA, so we’ll take a tax hit on that. I’m wondering if we may have lucked out because our taxable incomes were nearly identical? Idk, guess we’ll find out in a month or two.

My taxes are done with the exception of one 1099-R. Can’t find it on-line. Dang. Guess I gotta wait.

My taxes will have a new level of complexity this year

Wages (job that ended in March)

Interest/Dividends/Capital Gains (5 different sources)

Partnership Income (current part-time job, new)

Business Income (three sources of side income)

Clean Vehicle Credit (new)

8962 ACA premium tax credit (new)

HSA Contributions (no impact)

Beneficiary IRA distributions

Still waiting for my first of seven annual distributions of deferred income, don’t know if that will be treated as wages next year or ???

My big mistake the last time I changed jobs was maxing of SS Tax, between the two jobs and not recognizing it

Nah… your withholdings assumes your wife’s work earnings are $0 and her withholdings assume yours are.

If your incomes are nearly identical then the Married Filing Separately option should be very close to your exact liability outside of non-wage taxable income (interest, dividends, Roth conversions, etc) and deductions above the standard deduction.

If you itemize it might be that your itemized deductions save you, particularly if they are materially higher than the standard deduction and neither if you filled out the associated worksheet on the W-4.

Yeah, if you overpay on your Social Security taxes due to having more than one job then you can get the overpayment back on your income taxes. It essentially counts the same as tax withholdings or an estimated payment… either reducing what you owe or increasing your refund.

Tax software should catch and calc this for you. If you paper file and missed this on your 2023 or 2022 or 2021 taxes it’s not too late to amend and recover the overpayment… and they’ll even pay you interest! (Even though it was your mistake!)

Your employers overpaid too but the Social Security Administration gets to keep that money.

twig covered it.

I wasn’t aware the first time it happened and you get the overpayment back when the software catches it.

if you did the paper version yourself and missed it…that’s unfortunate.

i don’t think i could signal to the new employer that i already paid 80% of the SS and so they should cap me at some other figure. I doubt the employer wants to play that game

happened to me 25 years ago

I believe I did it by hand, then took it to HR Block to get a loan against my refund (needed the $$), they found the error

You can’t. The new employer is required to withhold your Employee FICA and pay their Employer FICA as if that is the only job you had all year.

All you can do is if you know you’re in that situation, you could reduce your federal income tax withholding to account for the Social Security overpayment. Just make sure you adjust it back on January 1.

The employer is not permitted to recover their Employer FICA. Even if the employee moved from one subsidiary to another within the same parent company. Like if you move from ABCDEF Life Insurance Company to ABCDEF Annuity & Assurance Company that are both subsidiaries of ABCDEF Holdings Corporation… you can get your overpaid Social Security taxes back, but ABCDEF is stuck overpaying the Employer Social Security tax on you.

That actually gives me an idea. Louis XIV’s finance minister quipped “the art of taxation consists in so plucking the goose as to obtain the largest possible amount of feathers with the smallest possible amount of hissing.”

Maybe Social Security could keep the “wage base” (the cap on earnings subject to taxation) for employees but get rid of it for employers.

Employers would pay their 6.2% on total wages (Medicare wages) and Employees would pay their 6.2% on the Social Security wages, which would also go into calculating their benefit.

That won’t completely fix Social Security, but it certainly kicks the can down the road a bit.

Oh, technically tips aren’t “Medicare wages” but you DO pay Medicare tax on them, so this is a pointless distinction. At the same time as we change the Employer Social Security tax, we could get rid of Box 7 on the W-2 and start including tip income in Box 5.

I assume most tipped employees aren’t exceeding the wage base, but I’m sure someone somewhere is.