How much in monthly payments are affected by the moratorium? Just curious what kind of money we’re talking about here.

I think that if we changed the law to make it easier to get rid of student loan debt in bankruptcy, those concerns could show up in that law.

One obvious possibility is “not for the first __ years after graduation”. Note that people who file chapter 13 don’t just erase the debt. They agree to a 3-5 year repayment plan that includes a trustee overseeing their repayments. Chapter 13 is for individuals with a “regular income”. And, of course, it’s not automatic. A judge has to sign off on the plan.

I’d expect that people who graduated with good job prospects wouldn’t want to be unemployed or sporadically employed for __ years just so they can file for Chapter 7.

I think it bears examining who is on the boards of the failed banks. I wouldn’t want them on any other corporate board requiring financial risk experience.

I’m not an expert but the debtors who went bankrupt on me filed for Chapter 7 and were awarded it.

He was a total deadbeat, but she was an experienced RN pulling in over $70,000 a year… $73,000 IIRC. This was in 2008 so that would be over $100,000 today.

They played an absurd game whereby they gave up their house as part of the bankruptcy BUT continued to use the expenses as their living expenses. Positively asinine that this is allowed, but it is established legal precedent that it is. And their house was a McMansion that they had an astronomical mortgage on and exorbitant property taxes, utilities, insurance, everything so their monthly costs in keeping the house were very high, thus qualifying them for Chapter 7.

Anyway, my point is that it is very possible to have a decent & stable job and still qualify for Chapter 7.

It is quite normal for doctors with astronomical earnings potentials to have low-paying jobs straight out of medical school: it’s called residency. And for the highest paying specialists some combination of residency / fellowships can take quite a while to get through. I think it takes brain surgeons 10 years after medical school before they start raking it in. But 7 figure salaries are not unheard of at that point.

Lawyers too often “pay dues” as associates at law firms before making partner and raking it in. Actuarial students have good job prospects while making less, on an inflation-adjusted basis, than the folks I dealt with.

I mean, I think it was actually 3 or 4 mortgages, but whatever.

When it was all over and I got about $0.04 on the dollar, I burned all of the paperwork in disgust so I can no longer check and see.

I think it’s more of a question of this would impact a wide swath of consumers discretionary budgets which is where the impact needs to be. Best data I can find is 43 million student loans and 93% are federal and all of those are in moratorium. So 39.99 million people have a loan in moratorium right now. Basically remove $200+ out of their monthly budget with many of them probably owing much more than that monthly.

Yes, there are both ways to have the $250k insured multiples times over, as well as optional insurance that is unlimited (Depositors Insurance Fund).

Thank for for providing a link to private insurance, after others have asked.

What is their premium rate? How does it compare to the rate I am currently being credited on my savings account?

Unfortunately, Truist is not among their member banks, so I don’t think I can partake.

I’ve no idea the pricing. I knew it was a thing and just Googled it to find the name. Apparently it’s offered via about 70 banks that are based in MA (though I assume there are branches outside of their home state.)

I never plan on keeping $250k in the bank either way so matters little to me.

Worse: people with no children deciding what all children be allowed to read.

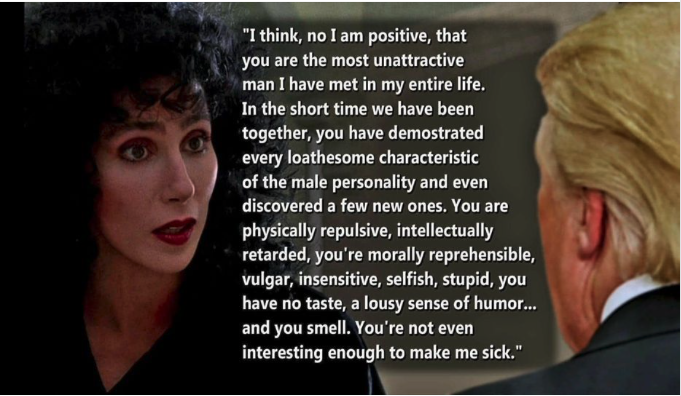

I feel like Trump was foisted upon us because he was a developer about to go bust and he started running for President to try to avoid bankruptcy and fraud charges. Then he realized a campaign is a really easy way to funnel money to yourself. Then he realized the Presidency is an even better way to do it. Seems like he was right. He has basically strung himself out for another 8 years now.

Remember all the folks saying he was going to use his business savvy to negotiate great deals to bring America great prosperity? Mexico would build a wall and pay for it, unskilled labor in the rust belt would suddenly get high paying manufacturing jobs, coal mining would surge, China would capitulate to give us favorable terms. None of that happened, but the true believers think it all did. If only he’s back in office it will all happen again. You just need to send him $49.99/mo and you will get a great job. It’s always been about personal grift.

I remember him talking about running in the 2000 election, so this idea had been percolating a while. It was in late 1998 or early 1999 that this was the buzz. He wasn’t married to Melania, but they were newly dating. And I remember an interviewer asking her if she was prepared to be First Lady. (She said she was.)

I scoffed at the question. What were the chances of Melania Knavs ever being First Lady? She’d have to actually marry Donald Trump and he’d have to actually become POTUS.

It was like a billion to one!!!