Dude, that’s a chimp.

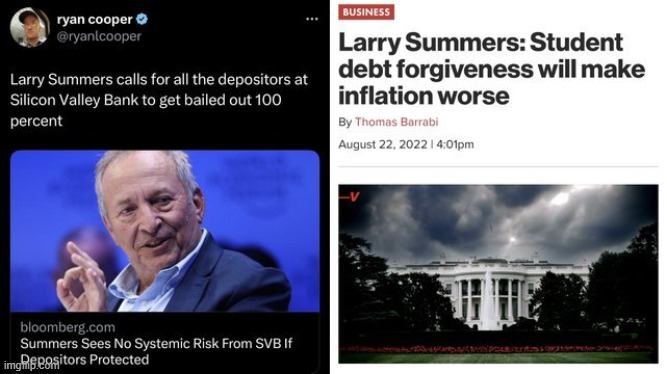

Do you not think there is a massive difference in protecting deposits and forgiving loans?

I do but I will say this: the rates that student loans were charging were high IMO, considering that the debt can only be discharged upon death. I’m choosing to view the forgiveness as a correction for that.

In fact I wish they would have just recalculated the loans at lower interest rates rather than forgiven a portion of the balances. You’d get to a similar place.

Uninsured Deposits are a gamble that the depositors made, and honestly they should pay the consequences for their business choices.

The similarities are a lot closer than many on the right would like to admit.

Why can’t businesses take “personal responsibility” for their actions? Do you only expect that from young people trying to better themselves through education?

I think young people should be allowed to declare bankruptcy and that’s about it. If you take a loan out you need to pay it back or pay the consequences.

Putting your money in a bank is very different. Also the government represents the people. The collateral damage of bank failures and rushes for deposits far outweighs the impact of making people repay their student loans. It just does. I’m sorry I don’t agree with this snappy meme. I’ll try my best to confirm next time.

There need to be some special conditions for getting student loans discharged in bankruptcy. It’s not right to borrow a ton of money to attend prestigious undergraduate and medical schools, and then during residency (or a fellowship) declare bankruptcy & get your student loans discharged shortly before accepting a job as a surgeon with a $500,000 annual salary.

On the other hand the person who borrowed $200,0000 but never graduated and is working as a barista truly has no hope of getting out from under the crushing load of student loans and legitimately needs a chance to start over.

Some rules that allow the second person to declare bankruptcy but not the first person are needed.

As for protecting deposits… I think that’s tricky. Certainly it’s a known risk to make deposits above the FDIC limit. But the alternatives aren’t great. You can try to spread your deposits to a bunch of banks, which is a logistical headache, or you can take the risk. I don’t think there’s private insurance for that type of thing. Maybe there should be? Maybe that would have exposed the problems at SVB before it was too late?

I think you conviently keep leaving out the “uninsured” aspect of these deposits. For the most part, the choice to have the deposits uninsured was the depositors decision.

Do you think the government should step in and pay for everyone’s uninsured medical costs (when insurance is available)?

Do you think the government should pay for 100% of reconstruction cost on uninsured homes in a disaster area (when insurance is available)?

How is making a gamble on uninsured deposits some sacrosanct thing that requires the risk taker to be made whole by the government, while all these other uninsured risks are different?

Is insurance available for the depositors? Aside from splitting their deposits into roundup( X / 250000 , 0) different accounts where $X is the amount of money they have to deposit, is there an option for them to buy insurance?

I have less sympathy if there is and they simply chose not to buy it.

The difference with banks is that the financial system require confidence in the system and losses of deposits can have consequences on the entire country.

Wealthy individuals with more than 250k in a bank account made a poor choice. It’s much more complicated for small companies.

Working capital for even very small companies easily passes that mark. Making payroll alone for a quarter or even just a month will be over 250k for a pretty small company.

It’s kind of why we have a whole bank regulation system in the first place. There was a time bank failures were much more common and depositors had little or no recourse. Times have changed for the better. It sounds like this may have been avoidable with tighter regulation on banking risk that from the other thread seemed to have been in place but were relaxed.

Especially a tech company.

Well first thing you need to understand is how banking and the FDIC works. The government is not stepping in and funding this. The banking system fully funds the FDIC. Their insurance rates may go up, but no funds from the treasury will be used to clean these 2 banks up. So that’s a moot point.

I also don’t believe the government should step in and take care of student loans. So I’m being consistent.

You are absolutely correct. This was a failure of deregulation. During Trump’s presidency Congress rolled Dodd-Frank back from banks that have over $50 billion in deposits to banks that have over $250 billion in deposits. Part of the stress testing requirements is (guess what???) checking to see if the bank could handle a rapid rise in interest rates. The last year SVB was stress tested was 2018 I think I saw. Both SVB and Signature Bank, which was closed last night, had around $100 billion in deposits.

Interestingly Barney Frank is on the Board Of Directors at Signature Bank which is quite ironic.

I am confident the financial system will protect the individuals and decision makers at the top of this disaster from severe financial ruin just as I am confident the government will protect the financial institutions involved in indenturing youth seeking to better themselves.

Sounds like an easy fix for congress and Biden to bounce that back to $50 billion in the next week or so.

You mean back down to $50 billion?

Here’s hoping

Yep. fixed.