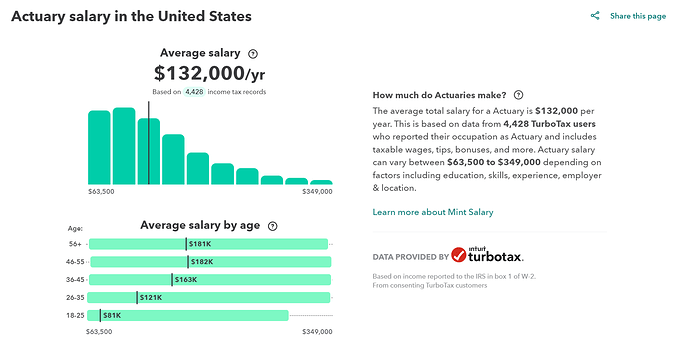

Box one is so variable depending on one’s pre tax deductions. Better than nothing, but I definitely was feeling a lot better about myself before I read the source of the data.

This feels like a data aggregation that just needs to be screwed with.

I wonder what occupation I’ll list on my next 1040…

Only 4k actuaries use turbotax? Are the rest of yinz using some fancypants personal accountant or something for your yacht tax write-offs?

I quit using Turbotax several years ago when I got frustrated with their copy protection efforts.

Not all of us use such luxury tax prep services as Turbotax! I started using FreeTaxUSA last year… basically the same thing but cheaper

I’m guilty. I did my own but it was down to the wire every year. When mr aj started a business we got an accountant. No business now and every year I think that I could do it myself but then I just keep writing that check. Even though my CPA is fancy now and the price reflects it, I’m usually getting enough back to more than cover it. And it’s nice to know it’s right.

Couldn’t find “Data Scientist” so I’m just gonna assume we’re winning

…or at least you have someone’s E&O insurance behind it

I’ve been using hr block online software for some time. Picked it once and inertia ever since.

my data point is in there!

I’m above average for my age group. Yaaas (for someone who works 5 hours a week)

![]()

I’m surprised it’s so many. TurboTax sucks. The one I use, which is so awesome I can’t remember its name, is CPA (my sister-in-law)-recommended.

UFile, $19.99 +HST. I don’t have ![]() muneez.

muneez.

I do my own, without TurboTax. ![]()

I’ve also spent a lot of time amending other people’s inaccurate TurboTax returns… let’s just say that I’m not impressed with the software. Granted, I only see the bad TurboTax returns, but still…

I will say that at a minimum, if you or your spouse has a business, talk to a real live tax preparer. Make sure you’re taking all of the deductions you ARE entitled to and not taking ones you’re NOT entitled to. (I’m looking at you, claimers of “business entertainment” expenses.)

Everything about my taxes is super straightforward, for better or worse.

Yeah, if they’re straightforward then TurboTax is fine, but there are cheaper options out there.

TaxSlayer.com for me. Some of the best features is the “carry forward” aspect that make e-filing so much easier. (Not that other online solutions don’t have this, but as another put it: inertia!.

And like @NerdAlert, my taxes are generally straightforward. I don’t put a lot of effort* into keeping track of stuff since I’ve found that the standard deduction usually is close to when I did put more effort into track for itemized deductions.

*I do put in effort; but for a different reason.

I don’t keep receipts for taxes. Standard deduction or I risk it. (chances of being audited is extremely low btw)