Usually organ transplants and long term hospitals stays which are mostly babies in the nicu or burn victims who need constant wound care

Has anyone mentioned yet, that the book, “Delay, Deny, Defend” is a book about P&C Carriers?

Shhh!

Ordinary transplants arent bad. Many/most are under $1m.

Multi organ or other complications…yeah, it gets higher.

Burns are bad. Can be at least.

Nicu depends a lot on the provider. Name brand childrens hospitals (national centers of excellence) can get bonkers fast. Those are for little ones who are struggling mightily.

The new gene therapies are for rare stuff as of now and cost 2m-4m for the single treatment. But i havent seen a case involving thosr grt much higher than that

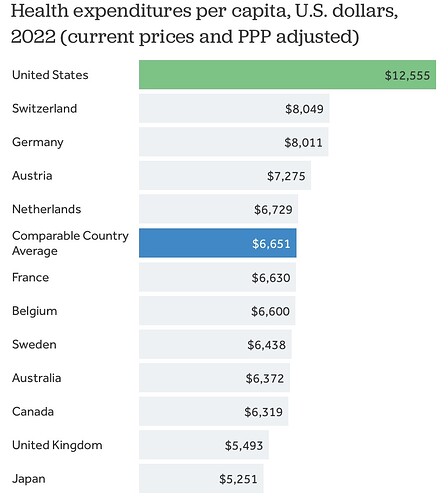

Isn’t this pretty simple? We spend twice as much per capita on healthcare as many other rich countries (see chart below) so we should expect to have by far the best system in the world; we don’t. Too many folks here still have poor care.

I am surprised that Canada, with about one-ninth of our population spread over a larger landmass, can provide a decent healthcare system for what they spend. Not surprising that there are waiting times for some non-critical procedures there as they must ration healthcare.

Wow that bill fell by over 60%. When I used to work in healthcare (not in the USA and during my training) the problem we had with hospital billing was the ratio of facility fees to treatment fees was so out of whack it was as if we were paying for treatment and a 7 star hotel. There were certain hospitals that were always in the range of facility fees being between 70% to 80% of the bill.

Those larger costs mean more than 20mn Americans owe some medical debt — in total they owe $220bn. Of those with debt, about 14mn people owe more than $1,000 and about 3mn people owe more than $10,000.

Canada would certainly not have any waiting times if we doubled our per capita spending on healthcare to the US level!

The US is generally more efficient than Canada in the production of goods and services. The big exception is the provision of healthcare where the US is inefficient due to its structure; it will always be more costly than other countries as a result. And there are too many vested interests in maintaining the current inefficient model for significant change to occur in the US.

Thankfully, medical debt is now largely an alien concept in Canada but it wasn’t always so.

Canada did not have a universal health care system until the 1960s. Before then, like the US today, folks faced economic ruin from high healthcare costs if their private insurer denied coverage or they had no coverage. That happened to my mother’s father. There must have been a dollar limit or possibly a pre-existing clause that prevented him from getting the care he needed for his serious illness through his private insurance policy.

He figured he would need to go greatly in debt if he paid his necessary medical expenses out of his own pocket for his treatment and lose his farm as a result. Rather than inflict economic misery on his family, he took his life in 1954 at age 58.

The preceding is one reason I am a critic of a healthcare system that depends primarily upon private insurance unless everyone is covered and there are strong protections for policyholders the way there are in compulsory insurance programs in certain European countries.

That is a very sad story. That would seem to be a situation where the family would be justified in its hate for the insurance company.

Guessing that the consequences of medical debt in the US would be different than your grandfather’s fate. US folks who have significant assets probably also have good medical insurance coverage so it is mostly poorer folks who run up medical debt? Those folks can declare personal bankruptcy rather than lose significant personal assets. Unlike your grandfather, if they owned property they would probably have little equity in it to lose?

Wow. I suppose I shouldn’t be surprised, but I am!

That sounds crazy. My experience with level 4 NICU care was closer to 5-10k a day early on, but it’s been a few years.

I felt some relief when obamacare eliminated lifetime maximums after taking out a big chunk of that in the first year.

I have no doubt that a majority of Americans have good insurance coverage and good care so they would respond favourably. The problem is the minority that don’t have this. In a universal medical care system everyone is covered adequately and the health outcomes reflect that.

that was somewhat unique. necrotizing fasciitis is awful. series of amputation surgeries and expensive IV antibitocs to try and get ahead. (all failed in this case) my job teaches me the ever growing list of things “you don’t want” and this is on it bigtime.

this is facility specific and is known as The Most Expensive Place. but if you need it, you need it.

**

i’d love to see US drug prices in line with other 1st world economy retail prices as a start

I tend to “over share” on this forum: it is therapeutic for me and this community is compassionate.

The stigma of suicide in the 1950s prevented my grandmother and my uncle (who found his hanging body) from telling other family members the true cause of death until after 1986 when my grandmother died. My uncle also said they felt guilty that they could have prevented it. The official story until then was that he died in his sleep from a heart attack.

Grandma received a small life insurance death benefit on his death so may well have been nervous criticizing the insurer in case that claim was denied. That death benefit was probably part of the financial justification in my grandfather’s mind to commit suicide.

Others are probably more knowledgeable about the history of the suicide exclusion in CN insurance law, but the quick reference I could find shows language and limitations to the length of the exclusion period existed in life insurance contracts well before the 1930’s. A 1938 court decision prohibiting payment to the estate of an insured who died by suicide (because it was a crime) caused the Association of Insurance Superintendents to propose changes to the law to permit it. I didn’t track down when those changes were enacted.

So, while limited suicide exclusions may produce some financial incentive toward suicide, the extra burden for the survivors like your grandmother of not having insurance that was paid for not pay a claim is good reason this legal conundrum was settled to permit payment.

When I started in the Canadian life insurance industry in 1972 it was universal to have a two year suicide clause in life insurance policies. I don’t know what was required in 1954 but suspect there were similar provisions in grandpa’s life insurance policy.

The average person is not a sophisticated insurance consumer. My grandfather had little education so he might well have had an inappropriate medical insurance policy. However he had been hospitalized previously with his illness and his policy covered it. For whatever reason, he was denied further reimbursement when faced with further treatment. It may have been as simple as having reached a dollar maximum under the policy? There is no one still alive in my family that can answer that question.

I said as much in the very post you quoted. ![]()

Glad we agreed then