Sure, people will defer purchases of things in accordance with their demand elasticity, but this all has significant ripple effects. You get an agg demand shift that causes further agg demand shift as people lose employment.

I would propose that deflation has much more to do with a response to unsustainable economic growth (aka “bubble-popping”) than it does conscious decision-making in an otherwise normal state. You don’t have things going normally and then in aggregate, everyone says whoa, I’m not buying, prices are gonna drop soon! and it kicks off a mass contraction.

It can be argued that deflation is the result of supply being much greater than demand. Many of us who buy fresh produce for our kitchen tables are well aware of this. When the fruit or vegetable is in season and plentiful, great bargains abound. Buying melons in January is expensive and the melons are tasteless.

In a similar vein, todays inflation is an imbalance where demand is greater than supply. Rising wages are a core source of that increase in demand. Rather than interpret inflation as a purely monetary phenomenon, some aspect of supply demand is warranted. Note that the amount of stimulus cash dispensed in the US was not matched by other developed economies during the pandemic. Yet one glance at the inflation rates around the world informs that the “printing of money” does little to explain inflation today.

I won’t say that monetary supply is the only driving factor behind inflation. Certainly, asset supply can (and does) play a role, as evidenced by the 1970s.

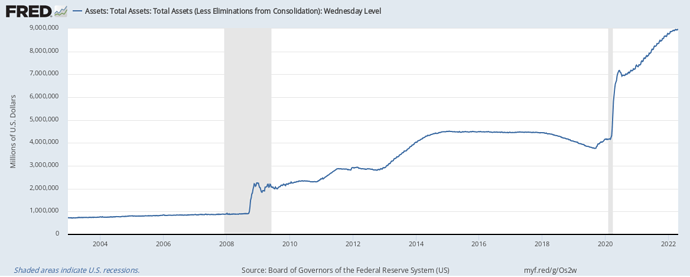

That said, let’s try a thought experiment: if the Federal Reserve reduced its balance sheet by half a trillion dollars today by selling Treasures and MBS - an event that would still leave it with some $8 trillion of assets - do you think interest rates on 10-year Treasuries remains at 2.8%? 30-year Treasuries at 2.9%? Will they be higher or lower? And how will that affect inflation, seeing as how the amount of goods and services in the economy hasn’t changed one iota?

Real issue is WHEN will the effect happen. I mean, this current inflation could be the result of 2008-10, combined with 10 years of delaying that inflation.

This is a great conversation. I’ll try and keep up.

The immediate impact of selling the 10 year is, obviously, a drop n price and hence an increase in yield. Presumably it is selling on the run bonds that were issued a while ago.

How it affects the long bond, and also inflation, will depend on whether this is seen as a one time shot, or an exercise that will be repeated. As a one shot, it won’t have much impact at all, especially if wage growth remains high. The supply/demand imbalance will remain. Strangely enough, it may even increase that imbalance if the higher 10yr rate discourages investments that could increase supply. Housing comes to mind. Hard to say there.

This nation has a serious problem with housing, transportation infrastructure and energy transmission. All would increase supply, albeit at a rate insufficient to bring about any change to inflation in a quick timeframe.

Pretend - and yes, this requires a nearly infinite amount of imagination - that the Fed is going to shrink its balance sheet to somewhere around inflation-adjusted (but not at 8% a year, even for the last year and change) 2007 levels and never wade into buying Treasuries and MBS en masse ever again.

It seems, if that is true, wages would be outrunning prices.

I agree that Eimon’s order is incorrect. It is well-known (empirically) that wages lag prices.

Feels like a bridge too far. You’re suggesting a rewrite of the central banks directive. What directive do you foresee? Income equality? Wealth equality? Maximum happiness? None of the above?

And please don’t say price stability because capitalism has business cycles. Just accept that.

We’ve seen it before. The late 70s. Conventional thought was wage increases were deemed necessary because workers expected inflation in the future. It’s a kind of self fulfilling prophecy. Dose the order even matter?

Perception is everything.

I’ve always considered the “Inflation = Expected Inflation” “fact” to be false.

Mainly, because people are more likely to change some of their spending habits if they expect inflation. They don’t go to their boss and demand a pay increase on some “I expect inflation” claim.

Well, you do you.

Fact is, that was exactly what the unions did.

I remember the wage price spiral, too. I’m just saying that wages can’t be the entire story if wages are falling behind inflation.

If people expect inflation, they buy stuff sooner. No reason to hold cash.

My recollection is that people expected raises because the raise they got last year had already been eaten up by inflation. So a lot of backward looking. But, also some expected inflation in the future.

Of course, we can “demand” raises, but bosses don’t have to give them. Maybe the company feels workers don’t have a choice or are easily replaceable.

I’m expecting the Federal Reserve to force investors to realize that there really is risk involved in buying securities, sometimes you lose money on securities, and businesses that operate in a shitty fashion don’t get bailed out to protect people from taking a loss.

I’m expecting the Federal Reserve not to flood the system with nearly 9 trillion fucking dollars to drive interest rates down and hold them there as long as possible, or bleat about not being able to interest rates because “the economic recovery is too weak” 7 fucking years into the economic recovery as the stock market is roaring ahead at 20-30% a year, or otherwise take actions to force everyone into risky assets whose prices get bid up under the belief that it creates a “wealth effect” that can increase demand and that such actions can be sustained indefinitely without creating massive problems at some point.

[Probably some other stuff, too - some of which I’m sure I’ve mentioned here and/or elsewhere - but I’m about to take a quiz on vegetables that a 12-year old with a wild imagination has drawn up.]

Maybe I missed somewhere in the first 70+ years where the Federal Reserve was tasked with doing all of that stuff, and you can point it out to me and everyone else. Feel free to point out where things like the Federal Reserve Act of 1913 or anything else passed pre-2007 authorized it. Also feel free to (incorrectly) assume anything else you think I think as you need to make whatever points you want.

Did the Federal Reserve flood the system with dollars, or did Congress? I don’t think the Fed has the option to say “no” when Congress says “give people money”, do they?

Quantitative Easing could certainly be considered a flood of dollars and that didn’t require any Congressional involvement

I can’t resist a teensy correction.

Depends on how much you really want to nitpick this.

When Congress said “send demasses money” it was Treasury who cut the checks. When Congress said “we vest monetary policy in the hands of the Federal Reserve” it wasn’t with a mandate to send demasses money at any point in time. I’m really sure it, nor anything since, gave the Fed authority to do this with its balance sheet:

Also pretty sure Congress didn’t tell the Fed “go buy things not backed by the full faith and credit of the government” like MBS and corporate bonds. That’s a Fed decision. So yes, I’d say the Fed flooded the system with dollars and did so in the absence of any directive from Congress.