All these profit seekers rushed in, even though Congress forced the GSEs to lose money on subprime mortgages? I think this story has a lot more than one chapter, and the later chapters are far more important.

Everyone was making money as long as the bubble was expanding.

The loan originators made out like bandits. They got the mortgage signed, took their fees, and sold the risk off to either F&F or the market as MBS’s.

The banks showed profits for shareholders and management got fat bonuses until the bubble burst and then they got bailed out. Even the AIG bailout was an undercover way to bail out the banks. That money was mostly used to pay of options held by banks at 100% instead of making them take a haircut in bankruptcy court.

The house flippers and home improvement industry did well.

The people who took out loans they couldn’t afford got hurt when the music stopped. I view that as mostly their own fault.

Middle and lower class taxpayers who weren’t taking out unaffordable loans got screwed with paying for the bailouts and by the resulting recession.

I agree with all of that. It shows that the problem was private, selfish actors who had no concern about the damage they were doing to other people. We think gov’t should put limits on negative externalities, the gov’t didn’t.

The gov’t telling the GSEs they should do more lending to lower income/poorer risk borrowers was maybe 5% of the entire picture. It came first, that doesn’t mean it was a necessary condition, nor that it was a large part of all the things that should have been done differently.

In a couple earlier posts I called out “subsidize” these loans. I think the GSEs discovered that they weren’t as bad as expected, and they actually made money from them. That probably influenced other lenders. If that’s true, it seems a stretch to complain about that gov’t action.

Makes me wonder how many of “the gov’t” had their thumbs in the pie as “private citizens” (or friends and family).

The problem is the politicians interfered in a well functioning market. They pushed for a specific political result at the expense of good economic policy.

It’s possible that the MBS structures would have come along without F&F buying up subprime mortgages. But the problem would have been much smaller and slower to develop without those GSE’s pumping money and guarantees into the situation. Without those the bubble maybe never forms and certainly doesn’t generate the high returns that made the banks go after that market even though they should have (and for some people did) known better due to investor pressure.

We’re debating alternate history here. With all the other players and decisions in the bubble, I just do not see

It may have been a little later. Stopping the next one involves a lot more than just not telling the GSEs to make higher risk mortgages.

The gov’t didn’t force all the private players to make the selfish decisions they did.

The other players got into the subprime because they saw the GSEs making money at it. It’s hard to argue it was a “well functioning market” if everyone was passing up a solid profit opportunity. It’s also hard to argue it was a “well functioning market” if people were able to make money with fraud.

I’m sticking with my 5% estimate.

Also: kids and grandkids and great-grandkids gonna, or are still, paying more taxes to pay off the bailouts.

Also: the people who bet the right way on Credit Default Swaps, because they saw The Big Short (not the book or the movie) coming, won big.

There was no well functioning market. Total myth. But you are correct that government rules define the game. So let me articulate the rules that encourage and allow this sort of thing.

Interest payments are deductible. Somewhat for home owners, in spades for corporations. The big concentrated debts are corporate. They form the systemic risks you’ve identified in the bailout.

Shell companies are allowed to go bankrupt without recourse to the owners. This is a big problem, not well understood. It means that Blackrock can have 8% of their LLCs go belly up, but not risk any of the gains from the other 92z. The shenanigans possible should be obvious. In fact, every one of those LLCs is essentially a bankruptcy remote, free call option. Any cash flows still present when the last debt is extinguished reverts to the LLC owners.

At some point, the accumulation of enormous wealth at the very top of the wealth scale has to be addressed. This is the source of the demand for all those fabricated securities. As long as that demand remains insatiable, you’re going to have problems to solve.

Stock buy backs gotta be punished somehow.

Because, at the end of the day the transactional nature of the current system will mean that private allocation of capital is doomed. No one in the biz cares if the assets perform. Guaranteed trouble, imo

It’s a fact that they did. Generic “Mortgage Backed Securities” aka “mortgage pass throughs” were issued by the GSEs in the early 1970s. They seemed simple to understand and plenty of people/institutions bought them.

However, pass throughs had an interest rate risk that ordinary bonds didn’t – the prepayment/extension risk that led to the infamous “negative convexity”. The big interest swings in the 1970s and 1980s made this very clear.

The GSEs started building multiple tranche CMOs in 1983. The impetus wasn’t “a place to put subprime mortgages”. Investors didn’t care about credit risk because the mortgages were insured. They cared about interest rate risk and the CMO structure allowed the bundler to chop that up and give investors only the piece they wanted.

The CMO structures were not invented to deal with credit risk. They were aimed at interest rate risk. They were invented without any impetus from subprime loans.

Exactly. The reason it all started in the 70s? Because two dudes demonstrated that a disciplined trading strategy that produced the exact pay offs as an option, was “worth” the same value as that option. Hello Fischer Black and Myron Scholes.

This was the revolution in finance. It was now possible to “buy” an option without any cash up front. All you needed was the liquidity to execute the trade. Here comes the debt. With a line of credit, you could write naked options, execute the trading strategy, and have to net position. Yuge

So far, this thread is fairly light on conversation wrt Bidenomics. I’ll presume that whatever Bidenomics is, it naturally includes that big ole piece of legislation, the inflation reduction act. Lousy name for a schematic for a new economic structure.

It pretty much hacks away at neoliberalism. Tax the biggest corporations? OMG, sacrilege’s. Transparency in Medicare drug pricing. That doesn’t sound like privatization. Increase IRS budget…tax on stock buybacks ( yeah, it’s a tiny 1%, but it’s a message).

The very idea of not signing free trade agreements Willy-nilly, acting like if it lowers costs for consumers it’s good, but without considering the workers it directly harms. Give the devil his due, Trump got that ball rolling.

Yes, I think it’s the beginning of the end for neoliberalism’s 40+ year reign.the experiment. Thatcher, Reagan, Friedman, and a whole lot of very serious people were wrong. Trickle moves up, not down. Individual freedom is more important than any community or group harm, gets really weird when corporations are deemed to have individual rights. Things were supposed to get universally better. The lived experience is just the reverse.

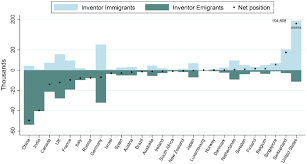

But the game ain’t over. Sure, we made a bad call. Still, I am optimistic. I’d take the USA over any other sovereign nation on the planet. We just need to lead with our best foot - people from all over the world want to be here. Especially the engineers and patent holders. As the prime minister of Singapore once said. “China can recruit the top minds from over 3.5bn people. The USA recruits from the entire world. It is not even a race.”

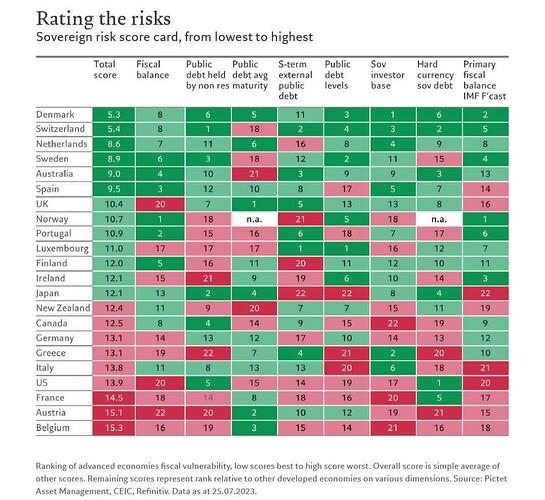

Bidenomics is starting to put the US in more dangerous sovereign risk territory though.

Table from Pictet Asset Management that looks at components of public financing for various countries.

Yeah, we are worse than the PIIGS now. Raising taxes or cutting the 3 major spending items (military, SS, Medicare) are verboten, so we continue to kick the increasingly giant can down the road.

Not sure exactly how the Pictet scorecard works. Prolly has to do with both default and inflation. Dunno.

But the brain drain into the USA is real and measurable.

why not both? We can have both irresponsible fiscal policy and a net inflow of highly educated individuals.

Looking at Friedman’s wiki: nothing in there suggests that he was an advocate of “trickle-down economics.”

If anything, he championed a progressive “negative income tax.”

Perhaps the people in charge thought that mean “negative income tax for rich people.”

Maybe I missed it, or that since he was an advisor, it was considered his idea.

Friedman was a central figure in the Chicago School as your quotation itself says. He was a monetarist, which vied with Keynesian economic thought. Keynes was most closely associated with the New Deal and his intellectual rival (Hayek) led the Austrian School. Neoliberalism became the ideological foundation for every President since Carter. Every President from FDR up to and including Nixon, were New Dealers.

Friedman didn’t coin the term, not even sure if he thought much about it. It’s convenient now to use the phrase to quickly sum up the economic philosophies of Neoliberalsim, since it was a key aspect of how that ideology came to dominate both the left and right. It was Clinton that mainstreamed it in the Ds.

The important part is: it doesn’t work. If I were to tick off some of the key aspects of neoliberalism, the first couple of items would be.

The individual comes before the group. This is the strongest value.

Privatization & deregulation ( small government)

Globalization (free trade of goods, services, and capital)

Austerity (fiscal responsibility means less social spending)

Corporations are a force for good.(the job creators?)

Strong military

So good ole Uncle Milton wasn’t an architect of neoliberalism, per se, but the Chicago school was important in dislodging Keynes.

Just remember that they all fiddled with the economy so they could get re-elected. No more, no less.

I dunno. My life experience includes at least a few water walkers…true believers. Folks that assume they are spreading truth.

They can be very persistent.