Introducing myactuary.ai - Your Ultimate Actuarial AI Chatbot

I am thrilled to announce the launch of myactuary.ai, a groundbreaking leap in the world of actuarial science. It’s not just another chatbot; it’s your personal actuarial assistant, powered by cutting-edge Generative AI technology.

What sets MyActuary apart?

While the world marveled at OpenAI’s ChatGPT, I was captivated by the immense potential of Generative AI. MyActuary isn’t merely a ChatGPT wrapper; it’s the culmination of extensive training on tens of thousands of actuarial publications, research papers, articles, and resources through vector embedding. The result? A truly formidable actuarial intelligence.

What can MyActuary do for you?

The possibilities are limitless. You can ask MyActuary any actuarial-related question, from crunching complex formulas to researching the latest actuarial regulations and standards of practice. Need an article or white paper on an actuarial topic? MyActuary can draft it for you with precision.

Embark on a journey with MyActuary:

- Unlock actuarial insights on pricing, reserving, and more.

- Dive deep into actuarial formulae with ease.

- Stay ahead of the curve with real-time updates on regulations and ASOP.

- And remember, sky is the limit!

Join us in shaping the future:

MyActuary is an evolving product, and your feedback will play a pivotal role in its growth. Try it out today, and let me know how it can further empower your actuarial journey.The age of Actuarial AI has arrived. Embrace the future with myactuary.ai.

#ActuarialAI #MyActuaryAI #AI #ActuarialScience #Innovation #FutureOfWork #AIChatbot #LaunchingNow

Truly formidable.

Dear Actuarial Chatbot:

Why does my data suck, and how can I get leadership to give a shit?

Asking for a friend, by the way.

Well, it told me to consult the user manual. ![]()

Damn, they really are trying to erase yall. ![]()

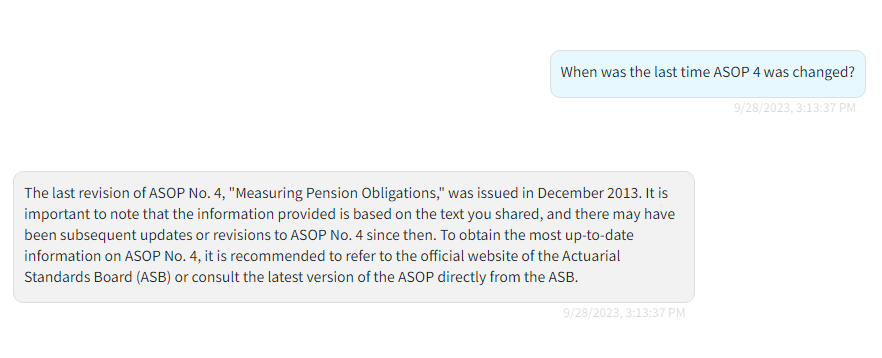

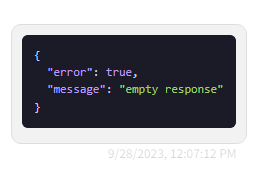

I think I broke it. It has been thinking for about 25 minutes at this point. And all I did was ask about some recent changes to an ASOP.

Oh?

After about 1.5 hours I finally deleted my question and when going back to it just now I see this (I originally asked my question at 12:07)

Is it using 2021 data like ChatGPT as well? Because that makes this claim highly suspect.

FYI - the most recent ASOP 4 revision was issued in December 2021

Huh, when I asked about most recently updated ASOPs, it gave me this:

Based on the information provided, the following ASOPs (Actuarial Standards of Practice) have been recently changed:

ASOP 4: Measuring Pension Obligations and Determining Pension Plan Costs - The most recent update is available at the following link: http://www.actuarialstandardsboard.org/pdf/asops/asop004_173.pdf

ASOP 27: Selection of Economic Assumptions for Measuring Pension Obligations - The most recent update is available at the following link: http://www.actuarialstandardsboard.org/pdf/asops/asop027_172.pdf

ASOP 35: Selection of Demographic and Other Noneconomic Assumptions for Measuring Pension Obligations - The most recent version is available at the following link: http://www.actuarialstandardsboard.org/pdf/asops/asop035_118.pdf

ASOP 44: Selection and Use of Asset Valuation Methods for Pension Valuations - The most recent version is available at the following link: http://www.actuarialstandardsboard.org/pdf/asops/asop044_116.pdf

Please note that the information provided is based on the links you shared, and it’s always a good practice to check the official website of the Actuarial Standards Board for the most up-to-date versions of the ASOPs.

Did you include a link to the ASB website? I didn’t, I just asked the question. Maybe it needs to be fed additional info.

Nope, I provided no links. My prompt was “What are the most recently updated ASOPs?”

It said you did.

So, who’s the liar? Or, who’s the bot??

(Or, did it sneak a look in your… your… browser history?)

Or it “hallucinated” (aka lied)

I provided no links.

Hi Ted,

Have you tried turning your computer off and then back on again?

-ChatGPT

Me: Tell of actuary qua management consultant

Actuarial chat bot: Actuaries, with their strong analytical and problem-solving skills, can also serve as management consultants within organizations. This role involves utilizing their actuarial expertise to provide valuable insights and recommendations to senior management regarding financial risks, strategic planning, and decision-making processes.

As a management consultant, an actuary can leverage their deep understanding of actuarial principles and practices to help organizations navigate complex financial challenges. They can assist in various areas, including:

-

Risk Management: Actuaries are well-versed in assessing and managing risks. They can help identify potential risks and develop strategies to mitigate them. By conducting risk assessments and scenario analyses, actuaries can provide valuable insights into the financial implications of different risk factors.

-

Financial Planning and Forecasting: Actuaries can contribute to financial planning by providing accurate and reliable projections. They can use their expertise in statistical modeling, data analysis, and forecasting techniques to assist in budgeting, capital allocation, and long-term financial planning.

-

Insurance and Pension Consulting: Actuaries possess specialized knowledge in insurance and pension plans. They can provide guidance on designing and evaluating insurance products, determining appropriate premium rates, and assessing the financial health of pension funds. Actuaries can also help organizations comply with regulatory requirements related to insurance and pension plans.

-

Mergers and Acquisitions: Actuaries can play a crucial role in mergers and acquisitions by conducting due diligence and assessing the financial implications of such transactions. They can evaluate the potential risks and liabilities associated with the target company’s insurance policies, pension plans, and other actuarial-related aspects.

-

Data Analytics and Modeling: Actuaries are skilled in analyzing large datasets and developing mathematical models to understand complex financial phenomena. They can assist organizations in leveraging data analytics to make informed business decisions, optimize pricing strategies, and improve operational efficiency.

-

Communication and Stakeholder Management: Actuaries often face the challenge of effectively communicating complex actuarial concepts to non-actuarial stakeholders. As management consultants, they need to possess strong communication skills to bridge the gap between technical analysis and business decision-making. Actuaries can translate technical jargon into easily understandable language, enabling senior management to make informed decisions based on actuarial insights.

In summary, actuaries can bring their expertise in risk management, financial analysis, and data modeling to the role of management consultants. By combining their actuarial knowledge with strong communication skills, actuaries can provide valuable advice and recommendations to senior management, helping organizations navigate financial challenges and make informed strategic decisions.

Me: Tell of actuary qua Pokémon trainer

Actuarial chatbot: While the concept of an actuary as a Pokémon trainer may seem unconventional, we can explore this idea in a fun and imaginative way. Let’s dive into the world of Pokémon and see how an actuary could excel as a Pokémon trainer.

-

Analyzing Pokémon Statistics: Actuaries are skilled at analyzing data and making informed decisions based on statistical information. Similarly, Pokémon trainers need to understand the strengths, weaknesses, and abilities of different Pokémon species. An actuary would excel at analyzing Pokémon statistics, determining optimal movesets, and strategizing battles based on probabilities and expected outcomes.

-

Risk Management and Planning: Actuaries are experts in risk management, and this skill translates well into the Pokémon world. A Pokémon trainer needs to assess the risks associated with battles, such as type advantages and disadvantages, move sets, and opponent strategies. An actuary would excel at developing risk management strategies, minimizing losses, and maximizing the chances of success in battles.

-

Forecasting and Predictive Modeling: Actuaries are trained in forecasting and predictive modeling, which are essential skills for a Pokémon trainer. They can analyze historical battle data, identify patterns, and predict future outcomes. By leveraging their forecasting abilities, an actuary could anticipate opponent strategies, plan countermeasures, and make informed decisions during battles.

-

Financial Management: Pokémon trainers need to manage their resources effectively, including in-game currency, items, and Pokémon health. Actuaries, with their financial expertise, would excel at budgeting, optimizing resource allocation, and making strategic purchasing decisions. They would ensure that their Pokémon team is well-equipped and financially sustainable throughout their journey.

-

Strategic Decision-Making: Actuaries are trained to make strategic decisions based on thorough analysis and evaluation of various factors. Similarly, Pokémon trainers need to make strategic decisions during battles, such as choosing the right Pokémon, moves, and predicting opponent actions. An actuary would bring a logical and analytical approach to decision-making, maximizing their chances of success.

-

Communication and Documentation: Actuaries are skilled communicators, as they often need to explain complex concepts to non-actuarial stakeholders. In the Pokémon world, an actuary would document their battle strategies, analyze their progress, and communicate their findings to fellow trainers. They could contribute to the Pokémon community by sharing their insights and helping others improve their skills.

While this imaginative concept of an actuary as a Pokémon trainer may not align with the traditional actuarial role, it highlights the transferable skills and analytical mindset that actuaries possess. Actuaries would bring their analytical prowess, risk management abilities, and strategic thinking to the Pokémon world, making them formidable trainers.