Just this morning it told me the closest international border was the VA line (currently in NC). It then proceeded to also outline that it was much closer than other international borders such as Canada.

Kind of thinking about holding out for $6000/oz Canadian. Up to $5650 today.

One of the most common questions on FIRE-related subreddits is “Can I retire with my savings?”

More and more often the answer is “Ask ChatGPT to run simulations for you.”

If it uses a half decent method, that seems pretty reasonable.

My guess is if you ask GPT “how to invest”, it will provide typical advice-- ie. IRAs, ETFs, some % stocks vs bonds, etc. And if the zillenials start doing that, it might improve their savings situation.

Otoh, if people just assume it’s a magic 8 ball, and obsessively ask it to pick meme coins, then maybe it will result in less than optimal decisions.

The question imo is wether it will cause people to ask more bad questions than they would normally.

We need a ChatGPT selected portfolio vs blindfolded dart throw selected portfolio

Mag 7 will not outperform the S&P 500. My comment was saying that its the Mag 7 that has been driving the index via the AI investment boom (services driven), while the rest of the index has been showing far less impressive growth (due to Trump and his tariff antics) as its also goods-driven (so tariffs affect their bottom line).

The current investment shift is being driven by reducing US Equties exposure to improve diversification. Financial Reporting in Europe has more regulations vs the US, as does Japan/Canada. Your argument would make sense in places like India and China where financial corruption is a more pronounced problem.

Being 80% in US Equities (as an example) leaves you very exposed to a dowturn in the US, so the general trend is to keep buying global equity (for upside) ETFs but that are ex-US so that when the downturn comes you are less exposed to the US.

This is tail-risk hedging because US valuations are not sustainable. The bubble will pop eventually.

From FT:

I think these are different things BTW.

Wondered why all my stocks were hurting today, checked the news, Trump is threatening massive tariffs on China and says he sees no reason to meet with Xi about it. Apparently we nixed some trade negotiations and called them hostile.

So much winning.

I’m sitting on a bit of cash as a lot of stuff that I invest in seems expensive at the moment with some things spiking in value. I was starting to question the wisdom of that, but I’m appreciative of Trump confirming that having some cash around us probably a decent idea at the moment.

Just another day in the Trump insider trading grift:

Nothing will continue to happen in the face of insider trading. The powerful won’t police themselves.

I don’t see gold going up that much primarily because at those prices the price would be extremely volatile.

Other precious metals are picking up some of the slack, but the market for these is nowhere near as liquid as gold is.

Your silver position should keep improving as more capital flows into the space given the latest US vs China trade problems regarding rare earths.

In general, I assume you know more about this than me. I think where I disagree with you on this is that I think Trump is intent on replacing Powell with a toady as soon as he has the opportunity and turn the US into a kleptocracy like Russia. I assume volatility is incoming.

I think we actually agree there.

Trump will very likely replace Powell with Hassett (an absolutely incompetent fool) who will do as instructed by Trump and drop rates quickly.

When that happens, you will see a significant increase in leverage in the US economy as people will borrow even more (at lower rates) to invest in risky assets (BTC will be the canary in the coal mine there).

Thats when the US will enter the economic danger zone with higher inflation and higher leverage, which will then combine with minimal regulatory oversight to create a very unstable and volatile economic situation.

At that point, the US would just become too risky to invest in.

Gold hit $6100 Canadian today. I’ve been a bit too busy to do much about it the last week as I’ve had a visitor the last week.

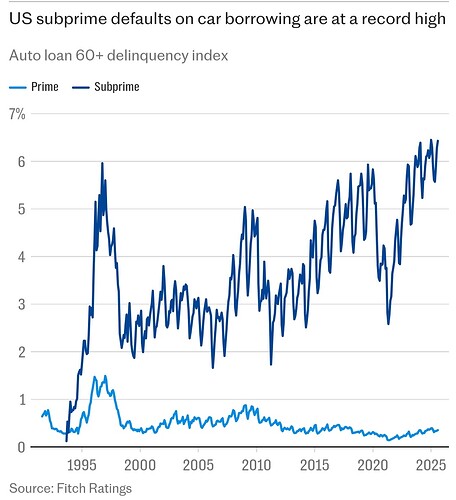

Prime default rates are rising but look pretty low historically. I wonder if underwriting is getting better in carving out those who will potentially default.

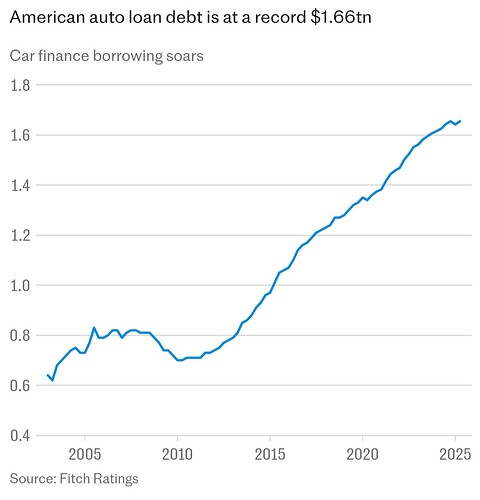

The total debt thing looks like it is just a function of car prices which have doubled since 2005.

As expected, we are seeing Gold being sold off now.

The $4.4k price just could not be sustained as there are other alternative investments now. Bubble just got too unstable.

Better to book a sizeable profit and move on.

Almost the entire existence of gold as a high priced commodity is a bubble. It’s a terrible store of value and is not strongly negatively correlated with the dollar. People buy it because they think other people will buy it for more later.