All I’ve seen is a bunch of people stating assumptions that they are spreading the drop evenly over the full 12 months. I think the validity of that assumption is the most important part of the whole discussion. We’ll see eventually. Think I saw final revisions come in January.

The monthly BLS jobs report is based on voluntary participation on hiring. Obviously, that can be pretty dicey. The revisions reflect “late responses”. Happens all the time.

- Annual benchmark revisions: Once a year, usually in February, the BLS conducts a large-scale revision using comprehensive data from state unemployment insurance tax records, which are more accurate but less timely. This process corrects for sampling and modeling errors from the past year.

And without a doubt, the Biden WH was talking up the economy, while seemingly ignoring the data wrt affordability coming out of various polls. Let’s not ascribe a nefarious motive without being realistic about how crappy the NeoClassical economic theory being employed is.

I was hedging for a reason. I don’t know the details well enough to know if the numbers are being fudged or not. I know that are adjustments are made all the time. I also know that the last person in the job got fired because Trump didn’t like the numbers and the new person in the job is a Trump toady. I also know that the Trump admin has recently released a number of reports recently where they knew the key conclusions and then wrote the report to support it, regardless of the facts.

My 2026 year-end projection for the S&P: 10,000.

Because … AI everything, we’re never having another drop, and if we ever do have another drop it will be viciously bought and the stock market driven to new highs. And, because the new Fed chair will drop rates to 0% like Trump wants and the market will fucking scream higher in response even as the long end of the yield curve also screams higher, because if there’s problems the new Fed will engage in unlimited, unrestricted QE.

Also, my personal gauge of sentiment vs. the stock market says 10,000 is a minimum; we might just double outright.

That must have been one big fortune cookie

We’ll likely need that kind of performance to stay ahead of the inflation we’ll get.

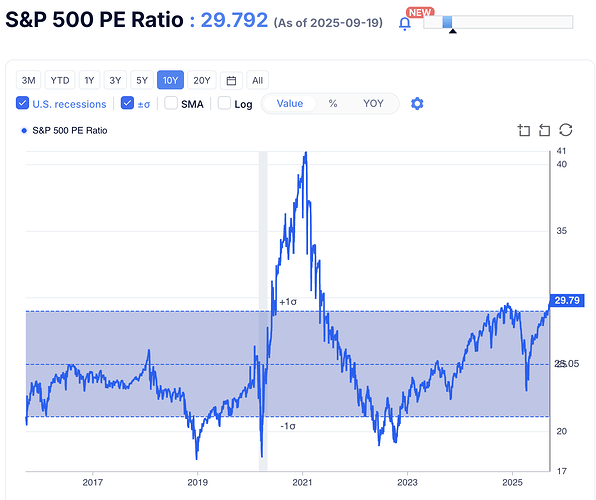

Shiller P/E on the S&P 500, P/B, Tobin’s Q and other valuation metrics, all at the top 1 percentile. Credit spreads likewise.

The Shiller P/E is above its 1929 peak, it’s only been higher once in recorded history and that was the end of the 1990s. There could be more upward momentum in the short term, but all bubbles burst.

I’m not one to time the markets but it feels super hot right now. I’ve been meaning to rotate more into bonds and I think I’m going to start doing that today. Maybe move over $50k every… month? Quarter?

If looking at S&P500 PE ratio, it’s hot but not super hot. It’s back to where it was before the big tariff scares -

I’ve stopped trying to make sense of it. The economy/trade news seem only loosely tied to the stock market.

And just in general, I’m planning to retire in like four years and I’m sitting around 80-85% equities. The past decade has been very good to me. Equities may go higher still but I’m happy to book some gains and buy more BND.

What is driving the stock market is the fact that there is still about 40% excess money supply (MS from QE) sloshing around the US.

Money is still flowing into the US stock market, but this is starting to change.

You are seeing institutional investors sell their US Equities and buy things like gold. Its the retail investors that are holding up the valuations by continuously pumping in more money into the indexes.

Its impossible to know when those capital flows might re-route from into the US market to ex-US markets in such a way that you would see large equity corrections.

I think that when the excess MS gets to c15%, that would be my signal to GTFO of US equities in a hurry.

I’m putting more $ into US but I will certainly reallocate the moment I don’t like it.

how are you quantifying excess money supply?

M2 money supply is still c40% above the pre-Covid levels.

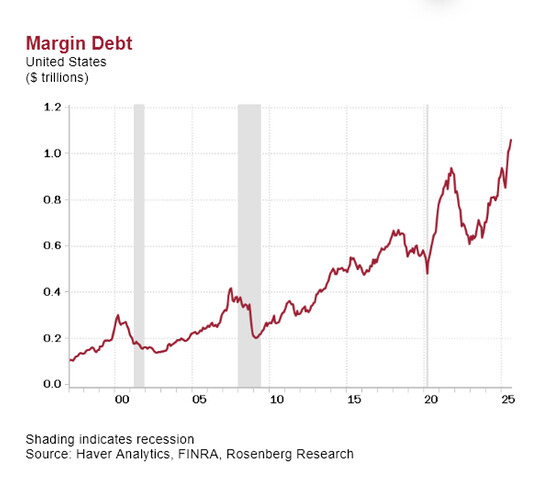

I’ve been getting a few offers for margin investing recently. I’ve previously used a line of credit to invest and did pretty well on it. I’m tempted to do it at the moment with the way stocks have been spiking recently, but the way Trump’s running the economy right now scares me. I suspect many aren’t as cautious as I am.

ETA: if it had been margin debt, I’d be in that rapid rise in 2020 and the rapid drop-off starting around late 2022 when interest rates started jumping up.

When BABA moves +10% on news that it will spend more money on AI - ignoring the fact that practically all the purported gains from AI have been proven to be illusory and not really flowing to the bottom line - you know we’re in a bubble. I’m fine with this, my BABA position is +55% since I opened it, but seriously. This is nuts.

This is concerning. Credit markets are very lax and regulatory oversight is now skewing to non-existent.