Don’t want to encourage further thread drift but end of life planning should be documented and discussed with spouse/children. Having said that, this usually doesn’t happen until after you have gone through this with your own parent(s).

I haven’t actually drafted a will yet, but the start of adoption is approaching and I plan to do so, will include.

Sign up for the legal plan next year if your employer offers it.

Glad I bought a few shares of an R2000 ETF a couple weeks ago. Up like 8% since then.

In March I got a Discover card with 0% interest until June 2025. Got the balance up to $7,500; only another $2,500 headway before I run out of room there. I figured a year-long interest-free loan was worth something.

This is in the US in an area where $18-20 USD is starting pay at McDonald’s. CNAs might be paid in that ballpark, but even so, unless hired through an agency, which would certainly be more, there’s employment taxes at a minimum. I’m not sure what level of care was involved in the scenario I mentioned, whether they needed an RN, or if LPN or CNA (or some combination).

This might be another -2% day on the S&P. Nasdaq is -3%, Russell is -3%, VIX is back above 20 as I type this.

Quite an interesting day in the markets, as we’ve gone from -1.6% on the S&P in a little over an hour of trading to the current +0.6% and still climbing.

Fed just added 50bps of rocket fuel to the S&P

Economic indicators are flashing amber but the market doesn’t seem to care as everybody else (EU, UK, CNY, JPY) is doing worse economically speaking.

Up another 11% since I wrote this.

We must be nearing the top of the market at this point in time.

Profit margins are not increasing anymore (in the aggregate sense) because consumers have really started to feel the financial pinch (and are changing their spending behaviors)

I have pushed my own risk tolerance as much as I dared, but have now decided to fully cash out (de-risk) and ride out the coming equity volatility.

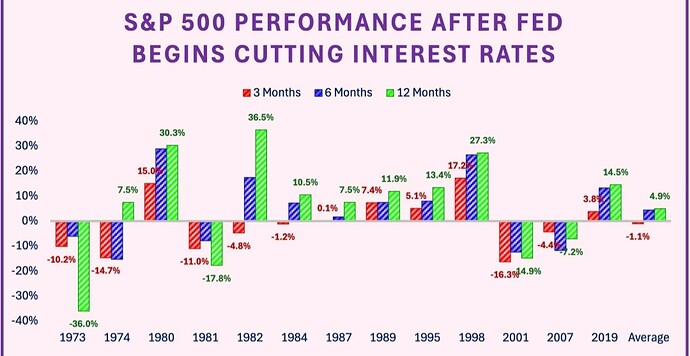

Here is the historical impact of fed rate cuts with lags.

I hope you mean lowering as opposed to eliminating your risky exposure.

Yes, lowering.

I’m not really sure what that chart is supposed to be indicating that makes it clear you should be selling off investments.

If anything, the chart suggests to me that why the rates were cut matters more than the rate cuts themselves. Perhaps its just that I’m not as knowledgeable? Wasn’t the 2001 rate cut in response to the Sept. 11th attack which resulted in a drop off in air travel and the imposition of a bunch of travel restrictions and tightening of immigration rules? The 2007-2008 cuts seem like they were in response to the banking crisis where from my limited understanding, banks, etc. were improperly pricing risk which caused cascading bank failures and imploding bonds.

I don’t remember what was happening in the 70s or 80s. Anyway, the plot leaves me thinking you’re more likely to miss on gains by derisking than to protect your assets.

The recent slowdown seemed to be due to rapidly rising interest rates making credit expensive resulting in people cutting back on purchases. The rate cuts reopen the spigot of spending.

Right, the fed was generally trying to stimulate the economy in those other years where now they are just managing inflation where growth has moderated. Might look more like 1998, so passing up the next 3 months might cost you.

I think most people ignore the covid recession as a real recession, but the economy did have a pretty strong reallocation of spending that could suggest a long period of strong growth could be expected.

Public debt levels are very high in the US.

While being the reserve currency in the world affords the US a significant amount of economic leeway it is not unlimited.

Boomers are starting to retire at a rapid clip so the size of the liabilities is growing very quickly relative to revenues.

The US is going to have to raise taxes and prune some of the spending side in order to keep going forwards given their debt service costs (which will have to be refinanced at much higher rates)

This means equities will be very volatile in the aggregate index sense (US), but you can still invest in one or two companies that are very likely to keep growing.

Effectively, we are the end of a very large asset bubble that was turbo-charged by covid spending and debt-fueled infrastructure subsidies.

Deflating it is going to be very tricky (and will be volatile).

I agree the U.S. is going to have to do something their finances. I’m a bit doubtful it happens in the next year. I though part of the drop in interest rates was to allow them to kick the can down the road for another few years.

The baby boomers retiring has been happening for about a decade now. They’re starting to drift into nursing homes in large numbers for dementia care and other issues. I suspect neither the US nor Canada is prepared for that. Their deaths are starting to accelerate which will lead to large shifts in funds to their families which I’m guessing will boost spending and investments by a new cohort.

Your expanded explanation leaves me less clear on what the point of the figure was as you seemed more focused on non-rate cut things.

The figure I posted was more for a historical snapshot.

The economic scenario at the time of the cuts matters as well.

In 2024, we have an asset bubble and high public debt levels.

In the abstract sense, this clearly points to assets being repriced downwards while we undergo some degree of debt % deleverage in real terms.

I guess we’ll see.

The Trump tax cuts expire at the end of 2025, so I imagine Congress will have to do something next year. What do I expect regardless of who wins the presidential election: more tax cuts and more spending. What should happen: tax increases, particularly on high earners. There’s not enough spending cuts to come remotely close to cutting the huge deficit, unless you make major cuts to SS, Medicare, or defense spending which I don’t think either party will do. Grandstanding about eliminating the Department of Education or Meals on Wheels doesn’t do much.