The stock market and Trump’s base of support are closely aligned. I firmly believe that before long Trump will reverse course and in the meantime, we get to accumulate shares cheaply. Of course I could be wrong.

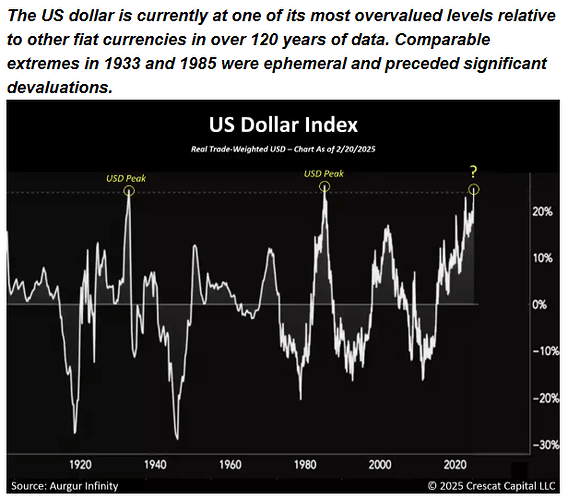

I don’t think this is quite correct. Its pretty clear at this point that their main intention is to drive down the value of $US Dollar as it is very over-valued. Bessent has made clear that the he is expecting the market to keep correcting downwards.

The difficulty here is trying to link a depreciating currency to impacts on economic growth (and then equity prices)

There are simply too many variables here to really give credible estimates.

The only thing you could really do is look at hedging and volatility (VIX?)

Other than that, you could park your money in more defensive investments and ride this out for a few years.

It’s distinctly possible that stocks could have negative returns for a year or two. If money that you’d invest is something that you’d need to spend within 5 years then safer investments are called for.

Over longer periods of time stocks almost always win.

![]() & this is always true

& this is always true

:ditto:

Started off +65 points on the S&P, it’s been pretty much straight downhill since - and no one in my circle is “wtf, I’m starting to feel a little sick about my 401(k).”

At some point there’s going to be a rip-your-face-off day, but the fact that everyone is “ho-hum, we’re staying all-in” tells me longer-term we’ve got more downside to go.

I also think there is a godawful day to come.

The good CPI number today may have provided an initial uptick until it sunk in that that was February’s number. Tariff inflation impact still to come and there is still much uncertainty.

I usually read these types of comments to suggest we are near the bottom.

I usually read “I’m staying in, I’ll ride every decline down because the market always goes up” type comments to suggest we’re near the top.

Went ahead and pulled about 3% out of large caps today. I plan to spread it between munis and international dividend payers.

I thought Trump’s economic guru was saying if you put tariffs on other country’s products you’d avoid an inflationary effect as it would push their currency down… More mismanagement?

I can’t say if the inconsistencies come from lack of knowledge or just plain deception, but I don’t trust any statements coming out of this administration about the economics of international trade.

I don’t think I’d make any allocation changes based on a 3% difference from target. To each their own.

There were some other minor tax considerations involved, but understood.

I mostly ignored rebalancing entirely until I hit 50ish.

They are basically saying that:

Initially tariffs will be inflationary but this will then be accompanied by a lagged USD currency adjustment downwards that should help attenuate those price rises.

There is of course zero evidence of this. Controlling the currency market is for the birds.

What is much more likely to happen is that the tariff induced inflation will be much more sticky, even in the presence of some USD currency depreciation.

Going to be interesting to see who Trump ends up blaming for his Trumpflation.

Eventually he’ll have a messy divorce with Musk and blame everything on him. Maybe

Mm, I’m increasingly believing that Musk has some solid leverage over Trump. Even if their goals have intersection, it seems like Musk has been essentially acting rogue, while taking over Trump’s briefings/interviews and forcing Trump to hawk Teslas in front of the White House.

This doesn’t feel even like a quid pro quo “you spent a lot of money electing me so I’ll let you into the grift”.

We’ll continue to have MAGA blaming Biden for everything bad, because Trump inherited the worst economy the world has ever seen.

I agree with this assessment.

My conspiracy theory since I have no real evidence is that Musk either interfered in the 2024 election for Trump or convinced Trump he did so Trump needs him for the 2026 elections. Or it could simply be Musk is bullying Trump from a position of greater wealth, and an aged Trump can’t mentally keep up.

That doesn’t make a lot of sense to me.

My impression is Trump et al. seem to be arguing tariffs aren’t inflationary as the countries facing tariffs will see their currencies fall, balancing out the increase in tariffs, so no inflation.

You say that the U.S.'s currency will fall as a result of the tariffs, which will reduce inflation. To me, that would magnify the inflationary effects of the tariffs as the U.S. dollar would be weaker and so those imported goods would be even more expensive. Or is the reduced inflation from reduced demand?

The US is banking on import substitution.

The more expensive imports (due to tariffs) will be replaced with goods produced domestically which are now cheaper.

So the timeline is like this:

Tariffs generate inflation initially

USD FX falls due to economic damage

Imported goods are substituted by cheaper domestic goods

Inflation attenuates due to this substitution

USD FX stabilises at a lower level than before tariffs

US Exports are now also cheaper

Of course, economic reality is a hell of a lot messier than this.

There are many things that the US cannot produce domestically. There is also no real advantage for them to do so either.