That doesn’t stop folks from challenging anything that didn’t exist in 1790 from being unconstitutional if it’s introduced now.

Yeah, after looking at something elsewhere I’m going to retract my point.

A revamp of what income gets taxed at what rate and the thresholds, rates and exemptions for estate taxes are probably the easiest way to accomplish this. And/or, some tax on transactional wealth when transferred from one entity (individual, corporation, whatever) to another.

Today is a good day to own silver.

Was looking into that today while waiting for a few runs to complete.

Silver/Palladium/Platinum

The common hedge against inflation is gold, but there seems to be little interest for the three commodities above.

Wow, gold is closing in on $2700 an ounce, which speaking of…is just enough to push this one over the line.

Taxing wealth would discourage small businesses, the majority of which start out as sole proprietorships. The small business is not liquid so that the owner can sell off a piece to pay the tax.

Also, many assets are difficult to value and may fluctuate significantly from year to year. The wealth tax could be subjective and fluctuate similarly with asset values.

The system of taxing capital gains at time of transaction provides a defined value (the sales price) and the seller has liquidity available to pay the tax.

You are going to get front row seats to what happens to investment when you jack up capital gains taxes so that they are on par with marginal income tax rates.

I agree its absolutely bonkers but the UK seems to be going down that road.

Well dividends should be deductible for the corporation just the same as bond interest is.

Then there’s no double taxation of dividends and no reason to not tax dividends and capital gains the same as ordinary income.

IMO ![]()

If you try to just tax dividends & capital gains as ordinary income you get everyone crying “double taxation”. Hence making them deductible to the corporation.

But I bet such a change (deductible to payer, ordinary income to recipient) increases overall tax revenue.

I have over $22K in gains on gold and silver and I’ve only held them a month or two. Being up $120K after the first six months of retirement is a nice feeling, good to have some additional margin already…

Maybe the trick is to tax dividends and capital gains from wealth more heavily.

We’re kind of in a weird place on taxing corporations. Lots of people say you can’t tax corporations because they just charge their customers more, so it just gets passed to consumers. However many of the biggest companies are multinationals and so from that perspective, I’d argue American tax payers should be saying “so what, that largely doesn’t affect us”. People in other countries are going to take that hit.

On the other side, we’re told dividends shouldn’t be taxed because the companies have already been taxes on the money and so it’s double taxation. But from the prior paragraph, we’re avoiding taxing companies. We’re also told we shouldn’t tax capital gains fully to reward investors for the risks they took. I’m not convinced that investors are taking on that much more risk than people who go to work for private corporations.

Taxing capital gains at marginal income tax rates only makes sense if you allow for indexation.

Favorable capital gains tax rates also only makes sense if you don’t allow a non-taxable step up in basis on death and yet here we are.

Don’t know if this is the case in the USA, but in Canada there seem to be a lot more ads in the past year on tv promoting the purchase of gold. That might be helping to fuel the price rise as the ads dwell on scary things that are already happening.

Nah, i divested my gold holdings near the beginning of the year guaranteeing the bull from there. ![]()

Have de-risked. I was making a rookie mistake and getting too attached to my portfolio.

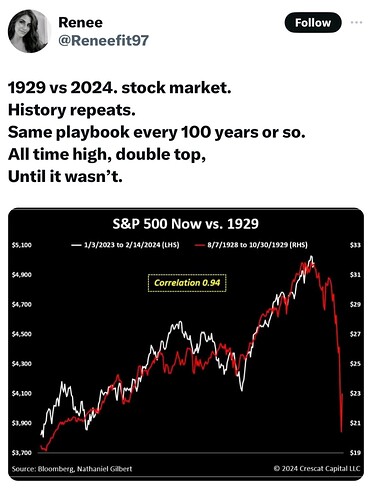

An acquaintance of mine shared this and I realised that I was not being objetive about the possible future trajectories of the S&P 500.

So based on that chart, the market should have crashed back in March?

It is also comparing a 6 week period to a 12 week period?

58 week vs 64 week, but both points stand, especially ignoring the ~14% return since 2/14

I was letting the feel good factor of ever higher returns (and increasing net worth from month to month) override my risk tolerance.

That chart (although simplistic) was a gentle reminder that you don’t need to be excessively greedy. A 50+% return over a few years is still amazing. Holding out for another 10% can be a very expensive proposition if the market tumbles.

Everybody here will have their own level of risk tolerance about these things.

S&P is also up 30+% in the year since this prediction