One outcome can be a larger middle class. Canada has less income inequality than the US and one result is a higher percentage of the population owning homes than in the US even though prices are higher on average in Canada than in the US and there are no policies like the deductibility of mortgage interest to encourage house buying.

Agreed. Recall that GDP can be measured in income terms or in spending (expense) terms. DistriButing the money more evenly, you are actually increasing the aggregate demand. Can be quite significant.

If you give a family worth $20bn another $10 min…basically nothing happens. Perhaps a tad more spending, but mostly an increase in wealth. Give that same $10mn to 10,000 families toward the bottom end, and you get a whole bunch of tha $10mn chasing after goods. inflation?..maybe. Increase in demand, no doubt.

All businesses have one “need” in common. They all need customers. More customers translates into more business.

Depends on how you achieve “less inequality”.

If we increased taxes on “the wealthy” and decreased taxes on below-median income, we would have less after tax inequality even though the before tax inequality would be the same.

We have room to increase taxes on wealthy people without getting remotely close to the right side of the Laffer curve.

Interesting concept: Create Laffer Curves based on Income/Wealth. Current Laffer Curve is simply the aggregate.

Assuming everyone has one that is unique to their existence, and that one factor in an individual’s Laffer Curve is Income/Wealth, AND, that the current tax rate of wealthy peoples is to the left of the max, while the current tax rate of poorer/middling people is to the right of the max, Progressive tax policies can be created such that more revenue is generated.

Same issue we have with the aggregate Laffer Curve: we don’t really have the information needed to conclude that such policies will work.

Sinema gets carried interest tax provision removed from Senate bill in return for her support. Victory for private equity managers.

I’m not sure that’s true. Money creates velocity and when people living check to check get more of it it creates a lot of velocity. It goes through a lot of hands. It also created situations where people could set out of work for a while which created shortages which also pushed prices. Now that cash has created much higher incomes for a lot of people and the money is being returned back to the federal government via the income tax and it’s starting to cut inflation. We’re even seeing prices retreat on many consumer products.

I think this has played out exactly as an economist would have predicted.

What if what really happened over the last 40 years had nothing to do with government policy and everything to do with demographics? Women went to work. The 3rd world industrialized and onboarded a few billion new workers. Globalization occurred. What if what really happened was just that for 40 years there were more workers than were needed so people could employ labor at such a price as to do basically whatever they wanted and the people with the best ideas made fortunes? What if that story is going in reverse and now the world has just enough or maybe not quite enough to do everything that people want to have done so for the next 40 years people are going to have to pay dearly to hire and also be picky about what they choose to actually complete? What if it’s all a demographic story after all?

That will totally motivate the job creators

I’m disappointed carried interest is still a thing. I’ve been hoping this would be eliminated since the Obama administration but I’ll take what victories I can. No way McSally would have voted for this under any circumstance so Senima is an upgrade in that regard.

I do think it’s time for a wealth tax. I realize that may require a constitutional amendment.

“pay dearly” compared to … ?

I pulled a country name out of midair and got “Malaysia”. Googling, I find this story about the gov’t wanting to raise the monthly minimum wage to $360 in USD. A global manufacturer can operate in M. and pay that or in the US and pay 10x that. It looks to me like globalization still puts downward pressure on US wages.

I can see the wealth trickling down already.

More money creates higher velocity only if it’s spent. [See: Fed’s dumping trillions of dollars into the system for years and no one spending it in the economy, and inflation barely moving as a result.] Inflation is really driven by the balance between demand and supply of products. If supply is high, pouring money in will sop up excess supply (again, only if that money is spent) and prices will remain unchanged. At the point supply becomes insufficient to meet demand, then you’ll see prices begin to rise as more dollars chase fewer goods. But it’s not necessary to have more money cause inflation. Inflation can occur even if money supply is constant. [I leave this as an exercise to everyone else to figure out.]

Beyond that: did 1-earner households really sit out of the workforce for months on end, instead collecting those sweet Trump/Biden dollars? Very likely not; they’re probably trying to make ends meet as it is, and that money wasn’t going to last more than a month or two for them. In 2-earner families, the lower earner was more likely to stay out of the workforce longer as their income got more than replaced. Where both earners kept working, the stimulus checks were effectively bonus payments, which created demand for extras that … well, you can take it from there.

Only in those sectors where the US is also performing the same work.

Also, don’t forget to include the impact of import duties for what pressure is really being placed on domestic costs (note: WRT the linked article, what other countries does Malaysia export to that need to be considered?).

Sure but relatively less pull every day.

That caused inflation too. It caused inflation in capital not consumer products and labor. Think about the valuation of property, stocks, bitcoin, etc. Fed policy impacts capital not consumer. Giving cash away impacts consumer.

I don’t disagree that the Fed inflating money supply inflated asset prices. That was the entire wealth effect that the Fed was hoping would translate to increased demand and increasing inflation. The average person gained nothing from increased valuations of securities, though (because most of them don’t own any of that stuff), and none of that moved the needle on consumer prices which is what the Fed kept targeting.

That’s why cash in the hands of consumers did it, but only after that cash wasn’t being used as a direct replacement for income and/or used to pay down debt like happened with the first two stimulus checks. And remember, the Fed opposed that approach to bringing up inflation because … I can’t recall the reason, other than it was pretty stupid - which pretty much sums up everything the Fed does.

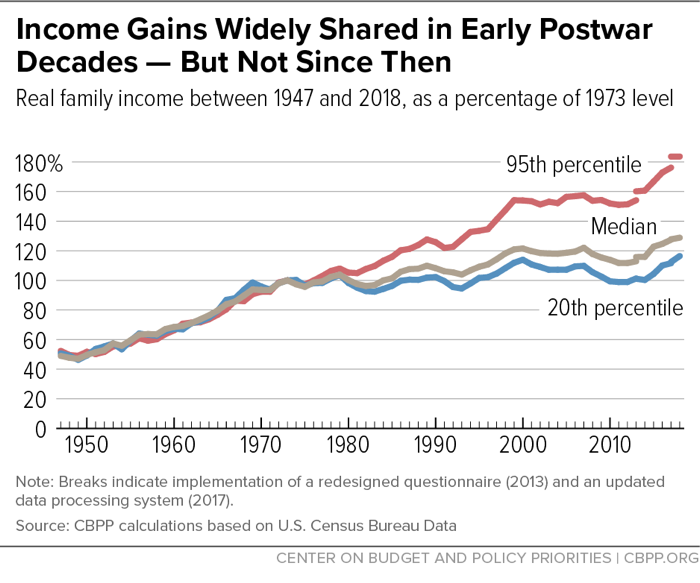

Looking at GDP growth since income inequality starting taking off, and I don’t see any reason to believe the higher inequality has lead to a higher overall GDP or a higher GDP growth. (If anything, the inequality seems to potentially be slowing the economy down.)

GDP Data:

https://www.statista.com/statistics/996758/rea-gdp-growth-united-states-1930-2019/

At this point, I have no reason to believe that decreasing inequality would do anything besides making lower income classes better off, it wouldn’t just be rich people making less.

I don’t know if that’s true. Getting on the right side of the Laffer curve for the ultrarich could help fight inequality. It would extremely discourage hording behaviors. Take Reagan’s own example. With the tax rate so high, he would pass on some roles. This opened opportunities for other actors. As a result, more actors had high paying good jobs than would have before.

Also, wealth isn’t a one-year event. If you decrease after tax inequality in one year, it should bring the pre-tax inequality down the next year.

I think inflation was driven far more by the Fed’s monetary policy of pumping cheap credit into the market, mixed with supply chain issues and a change in goods/services demanded. The supply of money surged upwards over the last couple of years. People tend to overly focus on the federal spending because it’s stuff they see and better understand.

I don’t think it’s necessary. I think we can accomplish reasonable equity without turning to a difficult to administer wealth tax.

Not necessarily. It might result in fewer movies being made.

Of course, but I would assume that happens in the minority of cases.