Yeah, uncertainty with adjustable rates also are a mess, especially if you don’t know you can refi when the adjustment happens.

I turn 50 in a couple of months. If my mortgage were 4%+ I would probably pay down some, but at 2.625% I just can’t do it. Instead of investing in bonds I think I’m heading the direction of a higher percentage of my investments in more dividend ETFs and utilities and the like.

We paid the house off early and don’t regret it one bit. Nice to not have a monthly rent/mortgage payment and only worry about the semi-annual property tax bill.

Was it the smartest decision? Probably not as we likely could have done better investing the difference between mortgage payments and the extra principal to accelerate payoff the but we’ve done OK with investments too taxable and retirement so I’m not worried about having a few more dollars in a brokerage account v house that’s paid off.

Timely bump.

Just last week I attended his funeral. His debt went with him.

Congratulations to him???

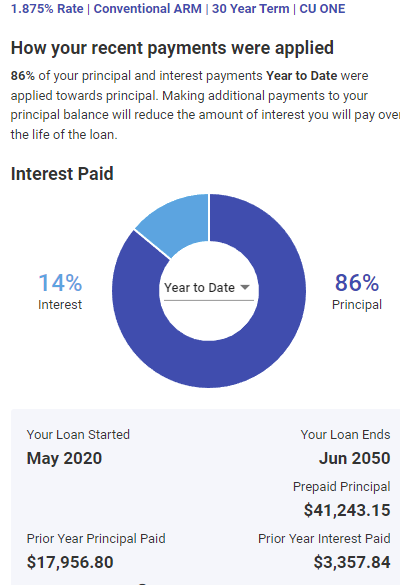

Playing around with some tools. My 7/1 ARM mortgage at 1.875% expires in 2027.

I’m currently overpaying $1,000/mo on a $776 mortgage. I know that investing is the better play, but I also put $900/mo into non-retirement brokerage to play both angles.

Using the bank’s calculator, if I bump that up to $2,500 overpayment, which is affordable, my mortgage will be done in November 2027… the first month subject to variable adjustments. Would be just over 9 years total including the initial mortgage and refi.

I know I should just continue investing. I have $110,000 in taxable stocks on a mortgage balance of $155,000, so I can afford to wait for the adjustment and see if it becomes 4% or 7.5%. May as well just keep the $1,000 overpayment until such time. But it’s tempting to be debt-free faster.

It is tempting. And being mortgage free is quite nice having hit that point a few years ago.

But what if you you setup a new account, I know a PITA, and call it something like “Loan Payoff Account” and send the $2,500 there in the meantime. An account you see as something for not for fun money, just a house payoff/emergency fund type thing. With current interest rates I’m sure you can do a whole lot better than 1.875% even in money market accounts. You’d have at least the payoff amount by 2027 and most likely sooner so you could pay it just before the rate adjust and have what ever is left in the account at that time.

That’s currently loosely what I do with $450 every 2 weeks (roughly the $900/mo mentioned). It’s in the taxable brokerage for “mega slush fund” - like when we total a car and get $4000 for the $12,000 purchase, we can just go buy a newer $20,000 car. It’s also going to fund a major vacation soon. But for the most part that $110,000 is “ability to pay off my house today” money.

I should start shoving $12,000/yr more into the stocks instead of overpaying. Even though it could of course lose money.

If you want to be debt free in 2027, you could buy bonds or CDs or whatever. Get a fixed 4-5% against the 1.875% mortgage, straight profit.

Also a tempting proposition. Though given I don’t have a firm end date (2027 just being the adjustment which will eat into my principal/interest ratio) it’s also tempting to put it all in the stock market and hope it works out.

Worked out for my down payment, saved in stocks starting in 2013, sold them in 2017, house purchased in 2018.

It minimizes risk, although if you’re on track to pay it off by 2027, even if you don’t you’ll have so little principle left that you won’t have any significant rate risk.

I also have a sort of amorphous blob of money in brokerage, it’s really there for retirement but I throw as much money as I can into it, and from time to time I take money out. I just buy S&P index funds, and I figure that since on average it moves up and to the right, I don’t worry much about maybe having to sell some in a down market. On average it’ll work out, so if you don’t have your sights set on 2027 as a must, then yeah.

Same, just add every 2 weeks, look at it every few months, pull a little out every couple of years.

At my current overpayment, by 2027 I’ll be under $100k on the mortgage with over $150k in stocks, counting (current balance + contributions) only. Maybe a little less after a vacation and it’s possible we buy a car this decade, but either way I should be able to pay it without exhausting that account.

I’m thinking I’ll just flip investments to be $1900/mo in stocks. Retirement is handled, 2024 will be the first year we will max out 401ks/IRAs/HSAs. Honestly, I’m considering a 529 with myself as beneficiary since it can be rolled over to a Roth IRA without penalty starting in 2024. We don’t have a kid yet but plan to purchase one in a year or two.

Love seeing this graph, hah. And my parents said “the first 10 years you’ll mostly pay interest.” Last year was 16% interest under the same terms.

You can put the money into TBIL. It’s currently paying 5.54% monthly dividends from 3 month treasuries so you will more than cover the interest on your loan with almost no short term downside.

The dividend tax rate should also be lower than your marginal, so if you get any benefit from deducting the mortgage interest you win there as well.

My understanding is that the “dividends” from TBIL will be [ordinary taxable] interest. I’ve only ever owned them in 2023 so I have yet to confirm that with any tax document.

Fair…I am in the same spot. I can’t find anything online to confirm or deny. They show up as dividends on my brokerage app rather than interest so I was thinking it would be taxed that way.

Some further research leads me to believe you were right, that they are dividends.

“ETFs, such as VanEck 1-3 Month US Treasury Bond ETF (TBIL), pay distributions instead of dividends . The difference is that dividends are declared by companies…”