Holy shit, my house would be almost interest-free by now.

Do you really want to hold that much money in a savings account that is earning almost nothing (except, perhaps, during those times when stock and bond prices are expected to fall)?

I know there are some savings accounts that are actually paying something these days…but I doubt that you’d be able to link those accounts to all-in-one mortgages.

(I could be wrong, however. I actually hadn’t thought of an all-in-one mortgage, except in passing, until Polymath’s question caused me to fire up a search engine.)

In UK they’re paying up to 8% -

If it weren’t for the fact that most UK banks wouldn’t want to service US citizens due to US reporting headaches, it would be fun to crunch the numbers to see, after considering expected future FX rates and risk, if it would be worth pursuing those accounts from this side of the Atlantic.

Oh, it needs to just be sitting in cash? Nevermind then, haha. I have almost the value of my home in stocks and my emergency fund combined.

Then, for ease of mind and some other stupid reasons, you should pay off your mortgage.

I’m waiting for the end of a 7/1 ARM in 2027 to decide what to do. If my rates spike up to 7% I’ll pay it off. If they’re back down to <4% I may stay on the minimum payments.

One of the nice things about most ARMs is there is a cap in the increase, so you might have a year or two after a big spike before rates approach current market rates.

I would hope that the current and expected future inflation rate would be a consideration on paying off a mortgage early.

It’s generally acknowledged that inflation favors debtors.

To fight inflation, the Canadian government has strong-armed grocery chains to freeze or reduce food prices.

Ok, which happens first: shortages or the black market?

Or simultaneously?

Yeah. Like toilet paper the day before the hurricane or snowstorm Except you’re unlikely to find anything edible in the local gas station’s restroom. So it’s not a perfect analogy.

Probably true on this side of the Atlantic as well. But what is the remedy? Boomers should reduce their spending so the economy will crash?

Interesting details. I’ve never heard of a “triple lock pension” in the US. Here, private DB pensions aren’t COLA’d, so increased inflation should be discouraging spending.

a recent Nationwide offer of 8% interest on deposits for current account holders at the building society. Meanwhile, Santander and First Direct offer 7%, also to current account holders.

Not sure about that. Are ordinary savings accounts popular investments in the UK? Maybe I don’t realize the number of Americans who have 401k/IRA money in guaranteed interest accounts. I think of bond mutual funds where I’d expect market values to decrease when interest rates go up.

As an American retiree, I don’t feel wealthy because inflation and interest rates are both up.

OTOH, I think that re-starting student loan payments is going to depress spending for younger people.

I have no trouble believing that travel spending is up, I think we are still in the rebound from covid. But, most of the vacation examples were to destinations outside the UK. That seems like it drains money from the UK economy.

They don’t exist in Canada and the US and are very rare elsewhere because they don’t make sense. However once you give this type of generous arrangement to a group it is nearly impossible politically to cut it back.

Your comment on travel is right on when it applies to international travel. I was astonished at how much prices in the UK for hotels, restaurant meals, etc., had risen just in the past year or so. However that is largely driven by foreign tourists rather than UK boomers. Conversely the Brits are spending a lot on travel in Southern Europe. It does, of course, increase UK airfares for the Brits to get there.

The “Triple Lock” is basically making the UK poorer and driving inflation.

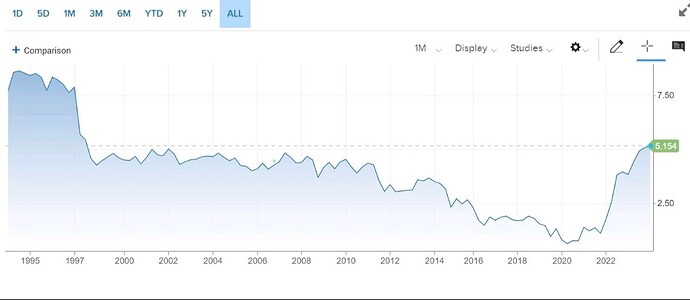

UK 30Y yields now hit 5.15% and they have debt service payments of £100bn (10% of total spending) due to 25% of the public debt being index-linked.

Inflation is still at 6% and sticky. More pain to come.

The “Triple Lock” is an uprating for the State Pension.

Its analogous to Social Security in the US and their COLA adjustments.

The main difference is that the uprating over here in the UK has become unsustainable as its a “pay as you go” public pension system, which is highly depedent on taxpayers (shrinking and narrow base) paying for those benefit increases (which compound over time).

The reality is that the UK is basically broke. It cannot afford to keep paying the pensions with a triple lock uprating when the infrastructure is falling apart.

Interestingly, that impact was mentioned in a YouTube video from a pilot I follow, who was remarking on UPS inviting pilots to take early retirement, and speculating on what tidbits from aviation earnings reports might mean for the economy in general.

The “triple lock” in the UK guarantees that the basic state pension will rise by a minimum of either 2.5%, the rate of inflation or average earnings growth, whichever is largest. It is too sweet an indexation.

In Canada and the US we do not raise social security pensions by more than the rate of inflation.

Just clarifying … the basic state pension goes to all retirees, not just retired gov’t workers?