??

why

Sell your house, go all in on tulips, I’ve heard nothing but good things!

I’ve been involved in more than a couple of real estate transactions in my life; buying, selling (what else is there?) and I’ve never felt that the realtors had my interests in the forefront. It seems like when we get to a closing meeting, the first thing they look at is the closing statement and to make sure the commission number correct. When I’m selling, they tell me to accept offers lower than my asking price. When I’m buying, they tell me offer full asking price.

I think the following saying is very appropriate: …like rats leaving a sinking ship.

Eh, based on your experience (and “Freakonomics”), realtors generally don’t seem to know anything about the market and are concerned only with their cut and how fast they can get it.

A better indicator might be when realtors quit, or scale back from, their jobs. Or start teaching others the real estate market for money (can’t do? teach).

I agree that a lot of realtors are shady but I really like my sister’s realtor. He seems pretty honest even if his honesty isn’t in his best interest for her finding a place and him closing a deal. That’s part of why she stuck with him and ditched a different realtor.

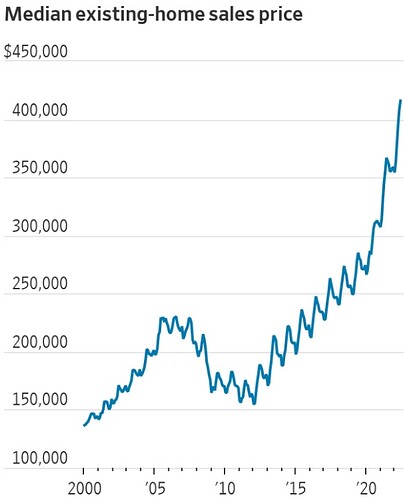

According to Zillow/Redfin, my house value is up $52,200 (+17.8%) in the last 17 months. I sold my last house in the in June 2005 boom. A couple years after the crash the house was worth about 60% of what we sold it for, and in 2020 I think the selling price was still lower. I’m not buying or selling now, but i does seem frothy to be going up that quickly. I expect some combination of higher interest rates, recession, and maybe supply catching up with demand after the pandemic will eventually settle things down.

I do sorta wish I could go sell and live in nowheresville for a while on the gain.

Isnt it crashing about now?

Things have changed recently, I don’t think “crashing” is the correct term, I think it’s more of a “the rate of increase has significantly slowed”.

good lesson to teach on the first and second derivative

local maximum @ 2022 (after more data points get added to this graph)

Why is that sawtooth (seasonal) pattern so pronounced?

It seems like you could just make bank buying a house every year and selling it the next quarter.

Except for those pesky transaction costs that are not insignificant.

It’s almost like there are other reasons people own houses.

or if I had to guess, the expenses are not covered by the seasonal swings

It’s hard to tell from the chart but if I had to guess families with kids probably don’t want to move in the middle of the school year and have a preference for moving in the summer. There might also be some seasonality created by when apartment leases are up. I don’t know if there is a most common month for leases to start and end but if there is, that would probably create some seasonality. I was wondering the exact same thing though.

People move more in the summer, easier on the kids to transition to a new school when the school year starts instead of mid-school-year.

The types of homes sold likely vary a bit too. On peak the houses being offered will be polished and freshly re done by the fixer upper types.

Off peak you’ve got more houses with no renos in 30 plus years being sold due to death or divorce.

Just as a follow-up. I did sell my rental. It was under contract quickly and easily. I walked away from closing with a very large check. I was being cheap and I didn’t need the funds right away, so I didn’t spend the $35 to have the funds wired into my account.

Now I just need to pay some capital gains taxes… grumble grumble

My friend is a tax accountant. He said if rebtal properties that you have to have a plan and exit strategy to be ready for the taxes. I dont have that yet, so i still own it!

just suck it up and pay the 15%