70/30 equities/bonds isn’t too unusual for a 40+ year retirement, from my reading. Some recommend more like 80/20 and some even more risky, but 70/30 seems common.

I would feel best retiring after a massive recession or stock down, feeling things weren’t so bubblicious.

9% of my portfolio is split between VCIT and VWOB, plus another 8% in some PIMCO ETFs (PCN, PDI, PGP, PTY)

I’ve been just another 500k from retiring for 15 years, I’m starting to think it’ll be just another 500k until I die.

I will be really interested to watch your story as the market inevitably dips -10% one year, and hopefully never dips -35%. That isn’t some warning, I’ll just be curious to watch your attitude and actions.

Targeting 13-16 years to FIRE.

I retired in 2018, and we had 4 big dips since then. Pretty much immediately I got hit by the dip caused by the crypto crash. S&P dropped about 20% late that year. 2020 was the Covid crash, and that was over a 30% drop. Then came the post Covid global inflation wave in 2022, causing a 27% hit on the S&P. Finally, we had the crazy tariff yoyo this year where the S&P was down over 10% and at one point down 23% from peak.

What’s crazy about all these big dips in a short time is that the market is way up over that period and probably due to have a big drop again.

I’m a pretty terrible investor. Who knows how much I would sell off.

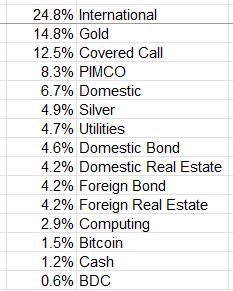

Here’s my current asset allocation:

I’m up $26k since my “update” two weeks ago to $1.84M. Yeah it could all go backwards any day. I lost about $75k during the Trump tariff thing but that’s all back now and then some. My bridge friends in their 80s weren’t phazed at all (holding more conservative portfolios) so I decided to dial things back some. Something in me wants to chase yield like a dog chasing a car, need to get a grip.

I let Fidelity do all this stuff for me.

I do my own rebalancing, but all I buy is some manner of stock index funds (I’ve got FZROX, VOO, VT, and VTI) and BND. Occasionally I’ll get bored and want to try my hand at buying individual stock and I’ll play with up to $10k.

My father and grandfather were into coins, especially grandpa. For mostly sentimental reasons I’ve got a few pounds of physical silver and one Canadian maple leaf (1oz gold). Oh, and $1,200 of crypto!

I’m a bit afraid to figure out how much I have in gold and silver at the moment. I suspect is substantially more than I think the way they’ve both been spiking recently. If it weren’t for a postal strike, I’d be trying to offload some of my physical stuff now.

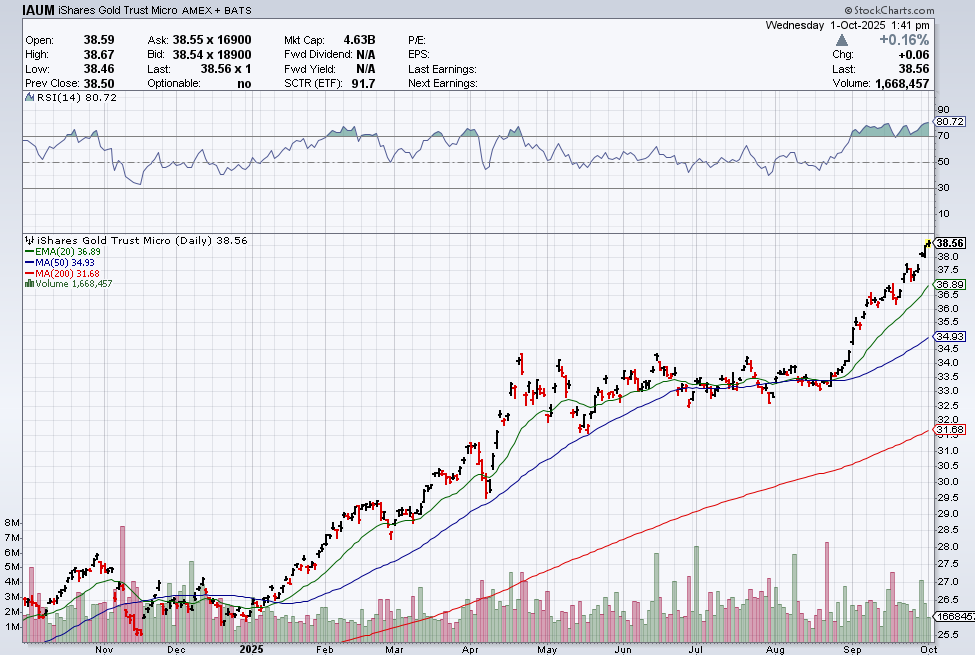

Yeah I think I’m looking to trim back (maybe from 15% to 5%-10%) for a short while (until the next interest rate drop if there is one?). Here’s a graph of the stock price of a gold ETF:

Currently at its most overbought apparently with a Relative Strength Indicator of 80.72. Then again who knows what precious metals are capable of. Although once it cooled I might buy more again. I have no faith in the government from a $ point of view. \Rickson

I am close to you in age and proximity to retirement. I have been moved to be convinced that the traditional pathway of high equities in mid career that tapers toward a fixed investment portfolio (bonds, CDs, HYSA, money market, etc) is outdated.

The alternative is to invest in growth equities in mid career (S&P 500, QQQ, etc) and instead of tapering to bonds, taper toward dividend paying equities. Over a mid to long time horizon, the dividend yields on high yield blue chips pay about the same as bonds, they also earn some asset appreciation, they have inflation sensitive yields, and the income is taxed more favorably than interest is.

Interest sucks. It really does. I hate it. I hate it because it is the worst unavoidable income tax maker I have. I pay my full marginal rate on my fed tax. I pay my full marginal rate on my state and local tax. I pay the full obamacare tax. And the real-value of the underlying asset depreciates with inflation. Sign me up for less of that crap.

I’ve thought about dividend stocks, kind of fell out of my brain. I still feel like I want maybe 5 years of expenses in something ultra conservative, dividend stocks may be less volatile but they aren’t immune to downturns. If I retire into a recession I’d like to have a decent runway to not have to sell any equities that are underwater.

But I suppose 30% bonds… that would cover like ~8 years of expenses. Maybe dial that back to 20% bonds and mix in 10% of something like dividend or blue chip stocks, not a sure thing but lower volatility than the broader market.

Maybe a dividend ETF?

No, not 100% immune, but greatly less affected.

If the economy takes a dumper, people vacation less, buy fewer houses, buy fewer appliances and cars and other major goods, they go out to eat less, and they may even buy fewer toys.

People don’t buy less toothpaste or toilet paper.

indubitably

They switch to cheaper brands though.

Brand choice is an illusion. There’s a very big liquor store called Binny’s near me. Hundreds of choices for beer. Hundreds of choices for wine. Hundreds of choices for liquor. But it’s all controlled by like 5 international companies: LVMH, Anheiser Busch, Diagio, Altria, and Constellation, are the vast majority of the worldwide producers.

In other words, they people making Crest and Charmin are probably making the Equate stuff for Walmart too. You think Walmart is making toothpaste and toilet paper?

Including myself if I’m retired and my assets tank. I need to read up more on the models where they adjust your spending in good and bad times. We will be retiring on a pretty decent ‘salary,’ so if I need to cut my Hawaiian vacation down to just ten days, or even vacation in Colorado or Maine (the horror!), sure.

I guess what I’m trying to say is I may be falling into my usual trap of being too conservative. The 4% rule is almost bulletproof for 30Y, I’ll have ~16 years until SS kicks in. And I can adjust my spend a little. And I will likely do some things here and there to keep earning some money post retirement, a la @Klaymen.

I have seen that adjustments called “bumpers” where the mean expected spending is capped at +/- 20% (ish) depending on bull or bear markets.

Also, research the concept of the “retirement spending smile”. The notion is that, over a long term retirement, spending is high in the early years when retirees are energetic enough to travel and spend on themselves, that number diminishes over the middle retirement years as energy & health levels wain, and the latter retirement years heat up with medical costs. So graphed out, that looks like a “U” shape on a graph, i.e. a smile.

Totally agree, interest is lame, and if you’re planning on retiring early and having a sizable stash of taxable investments, some focus on dividends could be a big part of the answer as they can help minimize taxes for sure.

As for dividend ETFs there are a lot of them out there. VYM and VYMI are good ones if you like a low expense ratio, I have 9.1% of my money in the there. If the stock only tread water, the dividend would be much different from the interest you would get, it wouldn’t be at the same tax rate, and over the last ten years they have compounded at +7.9%/yr and +4.8%/yr.

My PIMCO ETFs have some expenses and maybe a bit of leverage but yield in the neighborhood of 10% and rate to improve with potentially lower interest rates. And my foray into covered call ETFs is my desire to get something a bit steadier as well. I don’t need to hit it out of the park. Real estate yields for VNQ and VNQI are also in the 4% range as well.

I also have a chunk in covered call ETFs such as SPYI and QQQI. Those might be more dubious as I’m not sure how much downside protection I’m getting and how much upside I’m losing. I definitely would hold VOO and QQQM post-recession if valuations were lower.

Other possibilities are covered calls JEPI and JEPQ and other variants, plus JAAA and JBBB (or CLOX and CLOZ) which are CLOs. Alternatively BOXX will allow you to generate interest-like capital gains.

REITS. Don’t forget REITS. They’re tax efficient and can provide steady retirement income.

I have $0 in gold and twice as much in crypto.