I have added links to the first post in this thread to all the candidate answers I get

Mercy Yan:

Hi Mary,

Thank you for your questions. In Canada, the UEC program was implemented a number of years ago. We started with a course-by-course accredited system and moved to a program-by-program accredited system due to administrative simplicity and ease of control. There are many advantages of partnering and collaborating with a well-recognized university/college in the delivery of the required education such as:

· University/college has more employed resources dedicated to delivering the educational materials and instructions.

· University/college has a network with a broader group of employers representing many different industries.

· University/college is the first point of contact for many young talents to seek for higher education.

Broadening employment opportunities is one of the fundamental reasons for many young people to seek higher education. So it is necessary for any educational bodies to consider the employment outlook for their educational programs. Our profession has been dominating the insurance industry in the past. Unfortunately with globalization, the industry in North America, especially in Canada, has undergone consolidation in order to compete on a global scale. With consolidation, the employment opportunities for actuaries have diminished substantially, which led to membership shrinkage. This is inevitable when our profession is highly reliant on one industry rather than multiple industries. Thus, in order to maintain our influence and relevance in society, our profession needs to expand into other industry sectors to be sustainable in the long run.

The question would then become how we could effectively break into other industry sectors. This will require us to modernize our exam system to meet skill requirements in other industry sectors. Strategic decisions would be required to select the sector(s) that our current skill set could be easily accepted and value-added. I believe that the current SOA Board has selected data management (information-technology) as the top area for expansion based on the latest focus on data scientists.

Once the sector(s) is/are selected, the next question is how to complement our educational system to attract the new talents and also enhance our actuarial skills to meet the skill requirements of the new targeted industries. The decision to add a UEC system to the existing path is probably a good strategy to expand our employment opportunities for our members. I view this addition as an expansion of our career path for future actuaries. The skill requirements for this new group of actuaries could be different from our traditional examination group. SOA will need to establish a new benchmark/standard in measuring “quality” of this new group. Given the current state of our profession and the external environment, I am in principle supportive of the UEC initiative, but the success of this new venture will rely heavily on our implementation process and brand recognition.

You are welcome to share my reply with the broader community. Thank you!

David Ruiz:

Mary Pat, thanks for reaching out. My apologies for the slow response.

I noted in my Candidate Questionnaire that one of the most pressing international issues facing the SOA today is outsourcing and co-sourcing of actuarial work. This work often goes to actuaries who aren’t affiliated with the Society. In order to stay relevant in the international space, we need to make sure our education system doesn’t put us at a competitive disadvantage. I look at the University Education Credit system as a great step to ensure competitiveness. This program puts us on par with the Institute of Actuaries, which offers exemptions for preliminary exams to students in qualified classes in university settings. These exemptions make it easier for a student actuary to move through the credentialing process and get to ASA and FSA more quickly. This means that international students, when faced with the range of internationally-accepted professional bodies, will be more likely to choose the Society of Actuaries.

That said, I am concerned about the UEC program as it has been formulated when we think about barriers to entry for diverse talent. The UEC will only be available to students in Centers of Actuarial Excellence. If you look at the CAE list, it appears to me a very non-diverse set of universities. Of the 33 Centers of Actuarial Excellence, only the University of Connecticut is identified as a Hispanic Serving Institution by the Hispanic Association of Colleges and Universities. None of the CAE schools are considered Historically Black Colleges and Universities. We need to make it easier for Black and Latinx students to hear about and enter the Actuarial Profession. Opening the UEC program to a wider list of schools, based on educational content and quality of the specific courses rather than the CAE status of the school, would help address systemic inequity in our North American education system. As an elected board member, I would advocate for a more inclusive education system, while recognizing the benefits we get from our university accreditation program.

I am actually pretty excited about the direction the Education team is taking with the newly-announced micro-credentials and the changes to the early-career education system. Probably the most exciting changes are the introduction of the Advanced Topics in Predictive Analytics exam and the e-learning modules that will emphasize EQ/AQ topics. Understanding predictive analytics and how data science relates to the actuarial world is increasingly seen as “table stakes” for actuarial managers. We need the skills to manage and interpret data science work, and to help our senior business leaders get comfortable with the insights gleaned from advanced analytics. I don’t believe we need actuaries to become data scientists – but having a grounding in the techniques and capabilities of this adjacent profession will help us to be more relevant to company leadership.

Thanks for giving me the opportunity to answer your questions, and I welcome any and all followups. Let me earn your vote!

David Ruiz (he/him)

VP, Head Finance Actuary

Life Insurance Division

I’m endorsing John Robinson for SOA President-Elect.

Please check out his material:

Elections begin Monday, September 13.

Carlos Fuentes:

Mary Pat,

Thank you for reaching out to me. Please share my response with readers of GoActuary.

I’ll respond to your questions and then I’ll qualify my answers.

I do not support the current UEC program for the following reasons: it reduces the rigor of actuarial education; it gives an unfair advantage to some candidates; it gives the impression that minority students benefit disproportionally from this initiative. This impression has serious consequences in the professional lives of minority actuaries who, regardless of their level of achievement, will continue to be seen by a growing number of people as less qualified, recipients of undeserved favors, and undesirable. Even if the program eventually benefits a disproportionate number of minority students, the long-term cost to their professional careers would be much greater than the benefits.

I oppose the path to Associateship for international candidates practicing in the US under which, for many countries, it requires passing one exam and satisfy modest requirements. See details in International Section - International Actuarial General Information | SOA.

I agree with the changes in the education system that include micro credentials. Candidates will have the opportunity to obtain designations as they make progress with the exams, giving something to those who do not pursue an ASA and incentives to those who do. If employers see value in the micro-credentials, actuarial education system would become more relevant to the industries we serve.

To qualify my answer to the question about the UEC program I need to make two observations:

(i) The willingness of candidates to pursue actuarial credentials depends on three aspects: effort; expected rewards; comparison of the actuarial profession with other professions. Expected rewards have decreased over time as attested by unemployment and the abundance of actuaries, which ought to affect the level of pay via the supply-demand equilibrium in the labor market. On the other hand, whereas in the past actuaries had little competition from other professions, this is no longer the case

(ii) What is the ideal number of actuaries? A large pool of actuaries gives employers access to talent and reduces labor costs; it also increases the income of actuarial organizations but depresses the salaries of ASAs and FSAs. A small pool of talent produces the opposite effects and maybe additional consequences, which we must understand because some of them could be decisive. For example, if the profession becomes less visible, could it become less relevant? Could actuaries be replaced by other professionals—data analysts and accountants with training in the financial aspects of insurance? I am sure the Board has considered these questions and worked out scenarios such as the introduction of a single-payer health care system, which would transform the health care industry. The point is that we need to understand how the supply of talent affects society and credentialed actuaries.

If the number of actuaries is excessive then the UEC program is hurting the profession and the SOA should eliminate it. More broadly, the SOA should favor a stricter credentialing system. On the other hand, if society and actuaries can benefit from membership growth, then shortening the traveling time to associateship and fellowship is the path to follow, however unfair it might be to those who made great sacrifices in an attempt to pass the exams when the education system was stricter. But even if we concede that the profession must grow—an assumption that requires justification—the UEC program should be redesigned so that all candidates are treated fairly and are seen as equally capable.

Best,

Carlos

Alvin Soh:

Mary

Thank you for reaching out. These are 2 important questions and let me share my views. You may share my response to Goactuary community.

- On UEC, I generally disagree with its implementation. I hold the view that students who are ready in the relevant area can prove themselves by passing the exams. If the argument is that the current exam format does not reflect the ability of the student on the mastery of the subject, then we can review the delivery of the exam, but not to provide an alternative to the exam. After all- it is just that many exams- pass them if a student is serious. We are not imposing any minimum year of experience as a barrier to SOA membership so smart talents can prove themselves pretty fast.

A relevant argument for UEC is probably on the observation that younger talents may not choose to embark on actuarial courses during their university time but on some other courses/ subjects. UEC could be a tactic to hook the students and create awareness early. However, I view that substance of the issue is the relevance and marketing of actuarial profession in the new world, instead of marketing of actuarial career to the university students. If employers in non financial industries take the SOA certification as the quality assurance to their hiring of say, quantitative analyst, the demand will still be feedback to the next generation university students and I believe the demand will stay.

- On the recent exam changes, I am proud of the changes and I fully support continual evolvement as such. I am sure that there will be a lot of debates on whether actuarial science should compete with, or complement, or is data analytics. And I am certain that we need to evolve and exercise foresight on what the needs of next generation are and how actuarial profession continue to add value. I also support the idea of micro credential as they can be used as a way for the SOA to establish presence beyond traditional industries.

Personally, I believe the following 2 areas will amplify our core actuarial skills in the new world:

Leadership skills. I applaud the focus on EQ and AQ in the recent changes, which is part of leadership skills.

Technological knowledge. This covers appropriate exposure to both the relevant coding skills (e.g., pythons) and to most recent development in technological world.

These 2 skills are necessary because we will be living in a more interdependent world- where the ability to contextualize and influence will be more important than before.

Regards

Alvin Soh

![]()

Voting ends Friday!

Do you have a recommended slate?

.

@meep: do you anticipate endorsing any additional board candidates, or are those two the only ones worthy of that distinction?

Just curious if I should hold off voting or just only vote for two. I completely trust your judgment on this!

I will be voting for a full slate, and I’ll share who I’m voting for later today. I’m officially endorsing those three, partly because:

- they asked me

- I talked with them

- I agree with them on issues that are important to me

For other candidates, I am going not only by their official questionnaire answers (which are limited in info important to me, which is why I asked what I did), but often I’m also looking for a mix of fields/geographies/experience. I don’t want the Board to be too U.S.-centric, or too heavy in consultants vs insurance companies (or vice-versa), etc.

So my vote is not necessarily an endorsement of them, per se, but that I’m seeking some balance in board composition in these areas. And I may ignore that I disagree w/ them on UEC (for instance), depending on how I’m choosing as a group. You may weight other aspects more important than I do.

Ah, good to know. To me that is the most important issue.

Yeah, so the people I officially endorsed – I think they are closest to my opinion re: UEC.

The others… well, you see the answers above, and I didn’t get other answers. I don’t necessarily hold that against other candidates (we’re all very busy people, and I don’t expect responses necessarily), but I’m going to assume most are going to go along w/ prior board policy unless they explicitly state they don’t/won’t.

How I voted: [the people I endorsed, I bolded]

President-Elect: 1. John W. Robinson, FSA 1994, MAAA, FCA

2. Timothy L. Rozar, FSA 2004, CERA

3. David K. Sandberg, FSA 2001, MAAA, CERA, FCA

Board:

Roger Loomis, FSA 2007, MAAA

Carlos A. Sánchez-Fuentes, FSA 2006, FCA, MAAA

Mary Beth Ramsay, FSA 1996, MAAA

Alvin Soh, FSA 2012, CERA

Si Xie, FSA 2012, CERA, FCIA

I did go through all the candidate information, and all the candidates are very well qualified. As mentioned above, some of my other choices are informed by wanting people from a variety of fields, geographies, and experiences with the SOA, so when I chose, it’s from the board as a group. As noted above, for the non-endorsed people, I don’t necessarily agree with everybody I voted for.

Does SOA not have a formal way for members to ask all candidates a question?

After announcing the slate of candidates, CAS allows members to submit questions to be answered by all candidates, with their responses posted on the CAS website in the elections section.

Just spitballing, but my guess is that the SOA does not want membership to know what the candidates think of things like UEP, CAS takeovers, etc.

No.

And I was delayed in asking, because I was having trouble getting contact info for two of the candidates.

Last day, everybody! Get your votes in!

Argh, I wrote over my prior post.

Anyway, today is Sept 24, and it’s the last day for SOA votes.

Congrats to John & the other winners!

2021-2022 SOA President-Elect

Dear SOA Voting Member,

The Society of Actuaries (SOA) is pleased to announce the results of the 2021 Board of Directors Elections. John W. Robinson, FSA, FCA, MAAA of Apple Valley, Minnesota, will serve as the 2021-2022 SOA president-elect. Robinson is the first Black SOA President and he will begin his duties as the 74th SOA president at the 2022 ImpACT Conference, the SOA’s annual meeting.

The SOA also announces the newly elected members to the SOA Board of Directors:

- Sara Goldberg, FSA 2008, MAAA

- David N. Ingram, FSA 1984, CERA, MAAA

- Mary Beth Ramsay, FSA 1996, MAAA

- Si Xie, FSA 2012, CERA, FCIA

- Mercy Yan, FSA 1991, FCIA, MAAA

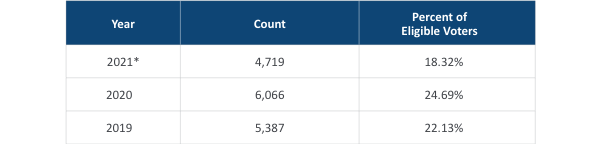

Past 3 Year Vote Counts:

- this year’s election took place over 2 business weeks instead of 3 as in previous elections.

Jennifer L. Gillespie, FSA, MAAA, will serve as SOA president for the 2021-2022 term. Roy Goldman, Ph.D., FSA, MAAA, CERA, will serve as past president for the 2021-2022 term.

Thank you to everyone who participated in the 2021 SOA Elections.

Society of Actuaries

Wow, 18% voting. Not exactly a ringing endorsement of the process.